Robinhood is an excellent stock, ETF, options and crypto trading platform that’s made a name for itself as a straightforward yet surprisingly powerful investing tool. You, like millions of other users, may already be familiar with Robinhood’s free version, but you may not be aware that they offer a paid membership called Robinhood Gold.

Here’s why Robinhood Gold is absolutely worth it. With the Gold upgrade you will:

- Earn 4% interest on your uninvested cash balance

- Pay no interest on your first $1,000 of margin borrowed

- Get access to Level 2 market date from Nasdaq

- Get immediate access to deposited funds

- Receive a 3% match on Robinhood IRA contributions!

So, what is Robinhood Gold, anyway? How much does it cost? Is it worth the hype? And most importantly, is Robinhood Gold safe?

Robinhood Financial LLC, as a broker-dealer, is regulated by the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA).

This Robinhood review answers your most burning questions about Robinhood Gold.

How Much Does Robinhood Gold Cost?

Opening a standard Robinhood account is free.

That’s in line with the company’s mission to democratize investing. Robinhood was the first digital investing platform to offer commission-free trading.

You may be wondering: What is Robinhood Gold?

In addition to its free accounts, Robinhood offers a paid subscription option called Robinhood Gold. It’s a way for Robinhood users to get access to some nice additional features.

And it’s still very affordable! As of March 2025, the Robinhood Gold cost is just $5 per month or $50 per year with an annual subscription. So you might as well make it annual and save $10.

They offer a 30 days free trial to see for yourself if it’s worth the investment. No commitments.

If you went for the monthly option and factored in the free trial, you’d pay $55 for the first year, then $60 for each year afterwards.

On the other hand, choosing the annual subscription means you’d pay $50 for the first 13 months, and $50 per year after that.

Either way, it’s a bargain considering what you get in return.

We’d be remiss if we didn’t point out that the Robinhood Gold subscription fee is far more affordable than most other premium investment platform subscriptions. The features are light in comparison, but many other options out there cost between $200 and $500 a year.

Pro Tip:

If you don’t have an account, sign up for Robinhood using this link, you’ll get up to $200 in a free stock. And when you refer friends, you can earn up to $1,500 in free stock per year.

If you already have an account, Robinhood Gold is their premium subscription that costs just $5 per month but is totally worth it if you have more than $1,500 cash in the account. If you already have a Robinhood account, click here to upgrade and try it free for 30 days. Best yet–upgrade to Gold and start or transfer an IRA and get a 3% match!

What Do You Get from Robinhood Gold?

Robinhood Gold comes with these major benefits:

- 4.00% APY interest paid on uninvested brokerage cash for Robinhood Gold Members, but just 0.0025% APY for non-Gold members

- Bigger instant deposits

- Professional research from Morningstar

- Level II market data from Nasdaq

- 0% APR on your first $1,000 of margin investing

- Margin investing at an interest rate of 5.75% (or less for account balances over $50,000)

- 3% match on eligible Robinhood IRA contributions

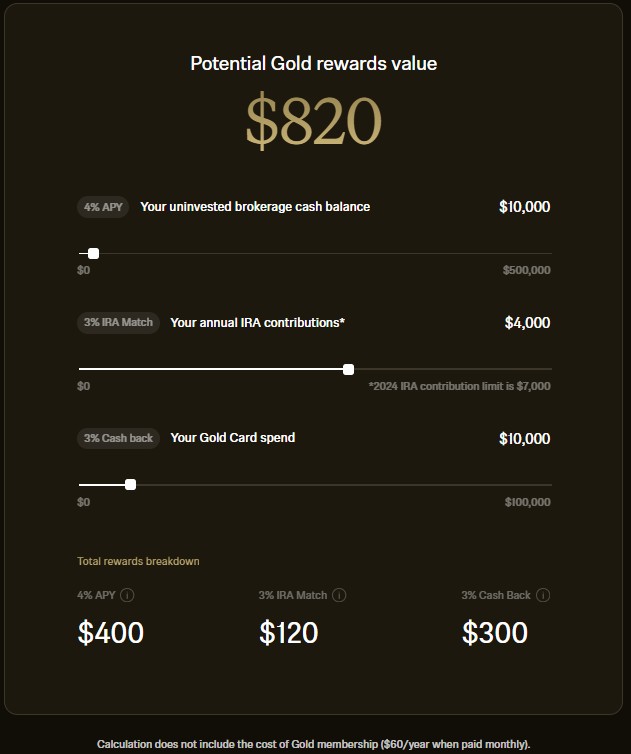

Since Robinhood Gold is only $60 per year if you pay monthly, there’s a good chance that any one of those benefits (with the possible exception of bigger instant deposits) could provide more than enough value to cover the cost of a subscription. Robinhood’s own page shows you how it is worth $820 if you have $10,000 in cash, make a $4,000 IRA contribution and spend $10,000 on their credit card.

Let’s dig a little deeper into each benefit and see what they bring to the table.

Earn up to 4.00% APY Annual Interest on Uninvested Cash

When I start using Robinhood, the first step involves depositing funds into your account, typically used for purchasing stocks, options, ETFs, or cryptocurrencies with the aim of maximizing returns.

If, for any reason, you opt not to invest immediately—perhaps after cashing out at a market peak or anticipating a prolonged market downturn—you have the choice to transfer the cash back to your bank account or leave it in your Robinhood account.

Opting for the latter and choosing to participate in Robinhood’s brokerage cash sweep program results in the uninvested cash being moved to one of Robinhood’s partner banks, where it functions as a standard insured deposit. Standard Robinhood members earn 0.25% annual interest on their uninvested cash, while Robinhood Gold members receive a higher 4.0% APY annual interest on their uninvested brokerage cash. While not exceeding inflation rates, this interest is more competitive than some high-yield savings accounts.

Is the Interest on Uninvested Cash Worth It?

You might be wondering: Is Robinhood Gold interest worth it?

Given the bump from 0.25% to 4.0% APY that Gold gives you, the question you should be asking is how much cash do I have to have in my Robinhood Gold account to make it worth the $60 annual cost. That at extra 3.75% will earn you an extra $60 if you have at least $1,600 in cash in your account.

In other words, the extra interest makes Gold worth it on this metric alone if you plan to have at least $1,600 in cash throughout the year.

$1,600 * 0.0375 = $60

It’s just math.

So if you plan to have at least $1,600 cash in your Robinhood account, it is absolutely worth it.

Pro Tip:

Robinhood Gold is Robinhood’s premium subscription that costs just $5 per month, after a 30-day free trial. Plus, when you sign up for Robinhood using this link, you’ll get up to $200 to spend on stocks. And when you refer friends, you can earn up to $1,500 in free stock each year!

If you already have an account, Robinhood Gold is their premium subscription that costs just $5 per month but is totally worth it if you have more than $1,500 cash in the account. If you already have a Robinhood account, click here to upgrade and try it free for 30 days.

Enjoy Bigger Instant Deposits

Instant deposits allow you to bypass the usual waiting period for funds to transfer from your bank to your Robinhood account, enabling prompt investment.

Without Robinhood Gold, your instant deposit is capped at a maximum of $1,000. In contrast, opting for Robinhood Gold significantly elevates this limit, potentially reaching up $5,000 or three times your portfolio’s value, rounded to the nearest $1,000.

For instance, if your portfolio is valued at least at $10,000, your instant deposit limit under Robinhood Gold is set at $30,000. The same principle applies for lower portfolio values, allowing proportional increases in the instant deposit limit.

Are the Bigger Instant Deposits Worth It?

Robinhood bigger instant deposits with Robinhood Gold as a benefit, but is it that big a deal?

Here are some Robinhood Gold instant deposit benefits and downsides to consider, starting with the benefits.

- If you’re eager to start investing, instant deposits can allow you to get a quick start

- Having access to an instant deposit worth more may be beneficial if you spot an investment opportunity and want to capitalize on it immediately

- There’s no additional cost with Robinhood instant deposits

Here are a few potential downsides to think about.

- If you’re someone who’s impulsive, you may not benefit from having instant access to the cash you deposit to Robinhood

- Ultimately, you won’t increase your profits if you take advantage of instant deposit with Robinhood Gold.

Otherwise this is more of an ancillary benefit than a real selling point.

Professional Research from Morningstar

What about Robinhood Gold research? Is it better than what you get with a standard account?

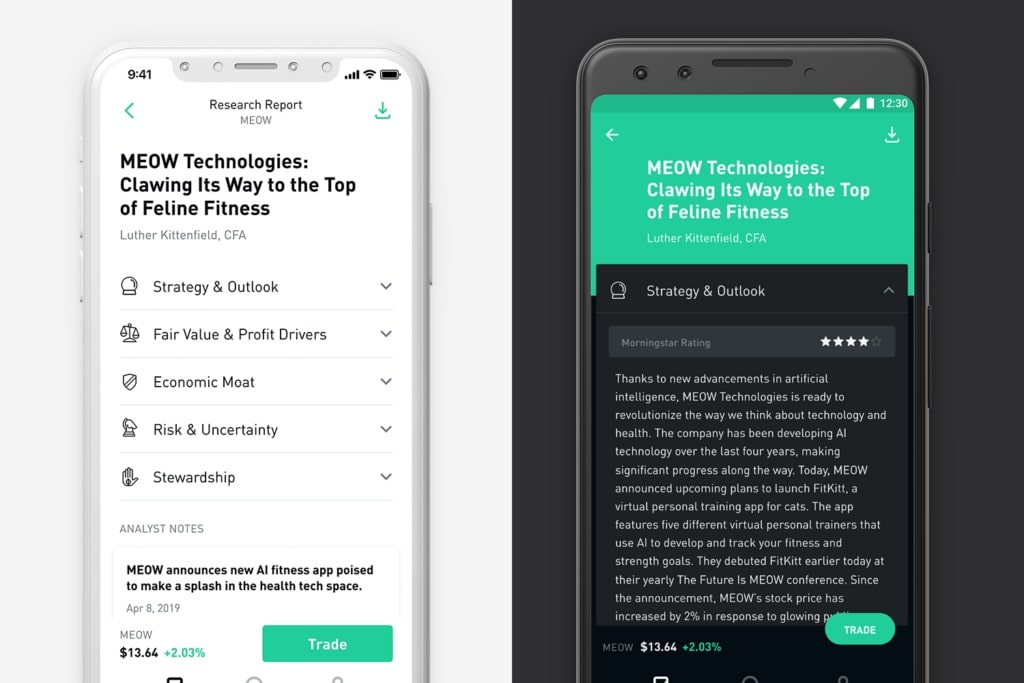

The good news for Gold subscribers is that they get access to in-depth research from Morningstar.

Morningstar is well known around investing circles. Their research is thorough, timely, and generally top-notch, and many folks subscribe to Morningstar for $199 per year (as of March 2025) for the research alone. (Read our MORNINGSTAR INVESTOR REVIEW.) Robinhood’s free version doesn’t have the best research and analysis features included, so getting access to Morningstar reports can be a big help.

A subscription to Robinhood Gold gets you access to in-depth research reports from Morningstar on around 1,700 different stocks, including up-to-date information about important events, fundamentals, data, and future prospects. There’s a reason people pay Morningstar big bucks for these things.

Is Professional Research Worth It?

Are Robinhood Gold research benefits worth the subscription price?

This really depends on the kind of trader you are. If you’re the kind of trader who does more trend following and technical analysis/prognostication than fundamental investing, you probably won’t get too much out of this feature.

If you’re the kind of person who likes poring over dry reports and drilling down into the fundamental factors behind stocks, their prices, and their prospects, you’ll get a lot out of Morningstar research.

From a pure dollar value perspective, $60 a year is a great deal for getting access to the product of Morningstar’s stable of professional traders and analysts.

Level II Data from Nasdaq

You’re already familiar with Level I data. It’s just the bid and ask prices, both of which are available on most platforms. Level II data goes a bit deeper. It shows you what’s driving those bid and ask prices, essentially showing you the supply and demand behind stock price levels. It’s great for getting a super granular look at what’s driving stock prices, but that’s about it.

Level II data is all the real-time information from the Nasdaq’s order book, which basically means you’ll get a much more in-depth look at the transactions driving changes in stock prices, such as:

- Liquidity

- Supply and demand

- Market makers

Active traders will benefit from having access to Level II market data, but if you’re buying stocks to buy and hold, you probably won’t have much use for it.

Still, it’s worth noting that most services and online brokerages charge (sometimes a lot) for access, so if you prefer a more active style of investing, the fact that you can get access with Robinhood Gold is great news for you.

Is Market Data Worth It?

This is a tricky one. Most people won’t ever want or need to dive into the Level II weeds. All that intraday data is only useful to people who are actively trading day in and day out, and that just isn’t most people’s bag. Speaking of which, if you want to learn how to day trade on Robinhood check out our new guide: HOW TO DAY TRADE ON ROBINHOOD!

On the other hand, you’ll probably get a lot of value from this feature if you’re one of those day traders looking for really detailed price information.

Access to Margin at 5.75% Interest

If you wish to invest in stocks, ETFs, options, or crypto but lack immediate funds, Robinhood offers the option to borrow money on margin.

The concept involves borrowing at a fixed interest rate, investing the borrowed amount, and generating returns sufficient to repay the principal along with interest, ideally leaving a profit.

The starting interest rate for both Robinhood and Robinhood Gold is 5.75%. If you sign up for Robinhood Gold, though, your first $1,000 in margin is interest-free, then at 5.75% for any amounts up to $50,000. The rates get lower as your margin balance increases: 5.55% between $50K and $100k; 5.25% between $100K and $1 million, and so on.

Is Margin Investing Worth It?

Again, it depends. If you’re a savvy trader who’s already comfortable using margin then yes, it probably will be worth it to you.

This feature probably won’t be too valuable to you if you aren’t the kind of person who likes to play with borrowed money. Why? Simple: you won’t use it.

The Verdict: Is Robinhood Gold Worth It?

Robinhood Gold costs $5 a month. For that price you get a small but diverse set of features that can pay for themselves.

Opting for Robinhood Gold is beneficial if you aim to earn interest on uninvested cash, require immediate availability of deposited funds, seek insightful research from Morningstar as a value investor, engage in day trading for more detailed price data, or intend to invest on margin.

In essence, Robinhood Gold is likely a valuable addition to your investment strategy. For more details on Robinhood’s features, our comprehensive research covers everything from their standard brokerage account and beyond.

If you are curious about how Robinhood compares to other popular brokerages, such as Fidelity, check out: FIDELITY VS ROBINHOOD!

Pro Tip:

Robinhood Gold is Robinhood’s premium subscription that costs just $5 per month, after a 30-day free trial. Plus, when you sign up for Robinhood using this link, you’ll get up to $200 in free stock just for opening an account. And when you refer friends, you can earn up to $1,500 in free stock each year!

If you already have an account, Robinhood Gold is their premium subscription that costs just $5 per month but is totally worth it if you have more than $1,500 cash in the account. If you already have a Robinhood account, click here to upgrade and try it free for 30 days.

If you’d like more information on the other features Robinhood offers, you’re in the right place. We’ve done plenty of in-depth research on Robinhood’s offerings, on everything from their regular brokerage accounts to their trustworthiness as a company. Protect your uninvested cash. Read our articles on the ROBINHOOD CRYPTO WALLET and ROBINHOOD IRA REVIEW!

FAQs

Robinhood Gold is the premium subscription service from Robinhood. When you subscribe to Robinhood Gold, you’ll get access to features that aren’t included in the free subscription, such as higher instant deposits, access to Morningstar research, access to Level II market data from Nasdaq, and 4% APY on your uninvested cash deposits.

A subscription for Robinhood Gold is $5 per month if you opt to pay monthly, for a total of $60 per year. If you pay annually in advance, you’ll pay just $50.

Yes. Margin trading is available with Robinhood Gold. If you subscribe, your first $1,000 of borrowing is not charged commission. After that, you’ll pay the standard commission rate of 5.75% for margins up to $50,000.

Regular Robinhood accounts have an instant deposit limit of $1,000. With Robinhood Gold, the instant deposit limit is $5,000 or three times the amount you have in your portfolio rounded to the nearest $1,000 dollars, whichever is larger.

Yes. Both Robinhood and Robinhood Gold employ state-of-the-art encryption to protect users’ holdings. Uninvested deposits are placed with FDIC-insured banks and user investments are insured up to $500,000 by the SIPC. You can use two-factor authentication and device protection for additional security.