For over three decades, Quicken has been a go-to platform for individuals and small business owners looking to better manage their personal finances. From budgeting to investment tracking, it’s built a name around feature-rich software that brings all your financial accounts under one roof.

But how well does Quicken hold up in 2025—especially in a world with newer tools like Simplifi (read: SIMPLIFY REVIEW, Mint, QuickBooks Online, Upgrade (read: UPGRADE REVIEW) , or Robinhood (read: ROBINHOOD REVIEW)? In this detailed Quicken review, we’ll walk through what the platform offers, how its plans are structured, and whether it’s still worth the price.

What Is Quicken?

Quicken is a personal and business finance management software owned by Quicken Inc., offering both desktop and cloud-based solutions. Its appeal lies in its ability to connect thousands of bank accounts, investment accounts, credit cards, and even accounts receivable—allowing users to see their full financial picture in one place.

Today, Quicken has expanded to support more platforms and user types than ever before. It’s widely used by individuals managing household budgets, small businesses, freelancers, and landlords tracking rental payments and expenses.

In 2025, the most relevant version is Quicken Classic, a software suite that includes Deluxe, Premier, and Business & Personal editions.

Key Features of Quicken in 2025

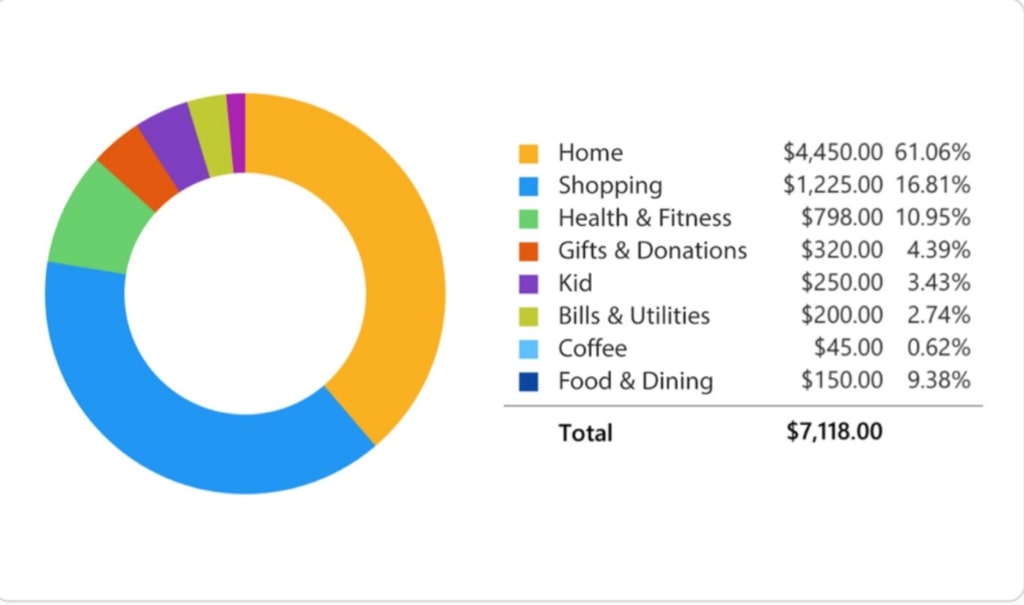

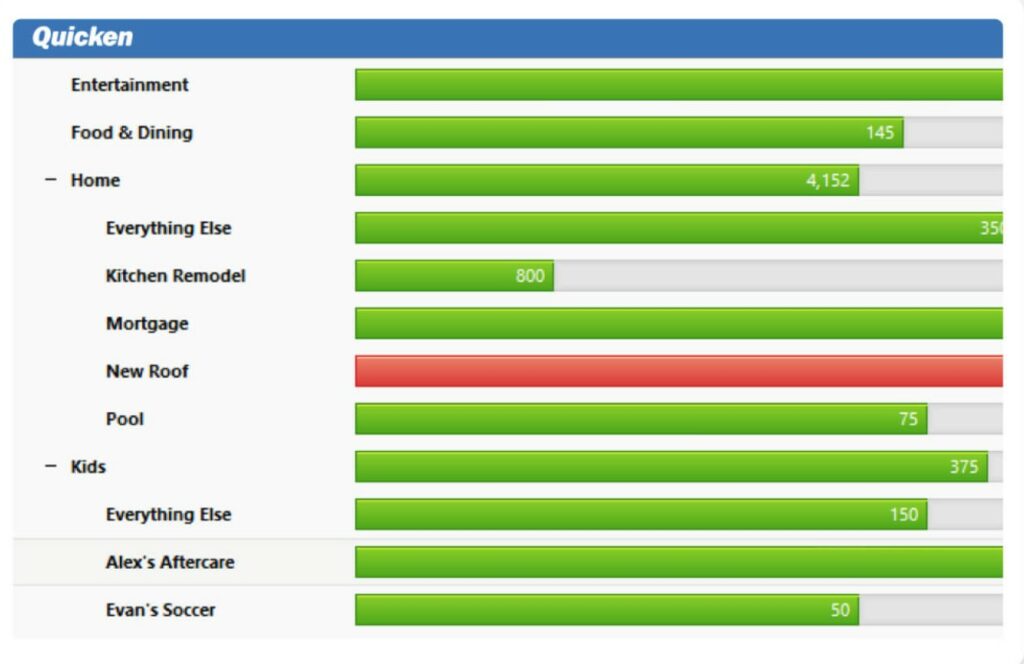

Quicken’s features vary by tier, but across all plans, users get powerful tools for expense tracking, budgeting, and net worth analysis. Here are some of the most important functions you can expect:

Dashboard and Mobile Sync

This feature helps users stay on top of their financial health from any device. Whether you’re traveling or just away from your main computer, Quicken ensures your most recent data is always at your fingertips. Users can monitor budgets, check balances, and even scan receipts into the app—all of which syncs automatically with the desktop version.

Lifetime Planner

It’s especially useful for users nearing retirement or those looking to set and adjust savings goals over time. The visual projections and scenario modeling help take the guesswork out of future planning.

Investment and Tax Tools

Quicken also supports tax-loss harvesting insights and can categorize investment transactions by type, offering an in-depth look at your portfolio’s diversification and performance. It’s a time-saving asset when tax season arrives.

Rental Property Management

It also allows landlords to track security deposits, property maintenance expenses, and generate profit/loss reports per unit—making it easier to stay organized and tax-ready.

Invoicing and Accounts Receivable

With Quicken’s invoicing, you can schedule reminders for unpaid invoices, apply discounts, and mark payments upon receipt. This built-in functionality helps avoid missed income and improves professional presentation.

Pro Tip:

Quicken offers top-notch finance tools for individuals and small business owners, such as business tax tools and rental property income reports. Right now, you can get started with Quicken for 50% off!

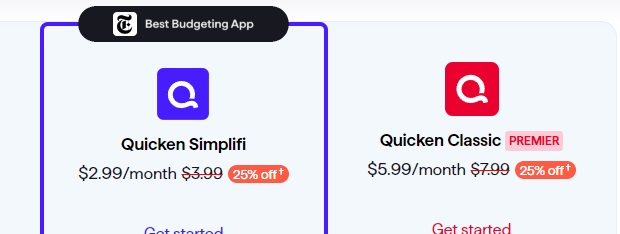

Quicken Classic vs. Simplifi by Quicken

With two flagship products under the Quicken brand, which should you choose?

Quicken Classic is best for users who need advanced tools for taxes, investment tracking, and rental property management. It’s also better suited for those who prefer local data storage, want detailed reporting like a balance sheet, or are managing more complex finances.

On the other hand, Simplifi by Quicken (read: SIMPLIFI REVIEW) is a modern, app-first tool designed for mobile users focused on budgeting, daily spending trends, and basic personal finance management.

Pricing: How Much Does Quicken Cost in 2025?

Quicken offers four Classic plan tiers:

- Starter ($4.99/mo): For basic budget tracking

- Deluxe ($5.99/mo): Adds savings goals, bill tracking, and more account types

For users who want long-term planning and support:

- Premier ($7.99/mo): Adds lifetime planner, priority support, and TurboTax integration

- Business & Personal ($10.99/mo): Adds rental property, invoicing, and small business tools

Simplifi by Quicken is a separate product and starts at $2.99/month (billed annually).

Pros and Cons of Using Quicken

While Quicken has remained a legacy tool for a reason, it’s not without tradeoffs. Here’s a brief overview:

Quicken shines for those managing complex finances or business finances with decades of proven features, a powerful lifetime planner, and robust syncing across desktop and mobile. However, users may encounter interface quirks or minor bugs like duplicating transactions.

Security, Syncing, and Bank Connections

Quicken syncs with over 14,000 financial institutions and uses 256-bit encryption for data transfers. Two-factor authentication is available for added protection.

While local desktop files can be backed up offline, the mobile companion app keeps your data accessible across iOS, Android, Mac, and Windows devices.

For peace of mind, Quicken follows FDIC-backed banking protocols through its partner connections and outlines its data privacy policy on its site.

Pro Tip:

Track your finances with precision. Try Quicken Classic or Simplifi risk-free with a 30-day money-back guarantee. Right now, you can get started with Quicken for 50% off!!

Is Quicken Legit?

Yes, Quicken is legit. It is one of the most popular personal finance tools ever, with more than 20 million customers over 4 decades. At this point, Quicken is basically a household name, and it consistently ranks highly in personal finance software comparisons!

Alternatives to Quicken

If Quicken isn’t a perfect fit, here are a few alternatives:

- Mint: Free budgeting app, discontinued in 2024 but some functionality now in Credit Karma Money

- QuickBooks Online: Full accounting software for freelancers and small businesses

- YNAB: Best for strict budgeters and cash flow optimization

Who Should Use Quicken?

Quicken is best for:

- Users with multiple bank accounts, loans, and investment accounts

- Small business owners managing income, accounts receivable, and rental property

- People who want in-depth financial tools like net worth tracking and detailed reports

It’s less ideal for users who:

Prefer minimalist apps or are just starting with financial planning

Want a fully cloud-based experience

Pro Tip:

Running a small business? Stay on top of accounts receivable, taxes, and cash flow with Quicken Business & Personal. Right now, you can get started with Quicken for 50% off!

Final Verdict: Is Quicken Worth It in 2025?

If you’re someone who values control, customizability, and serious financial oversight, Quicken remains one of the most robust personal finance tools available.

It’s especially powerful for managing business finances, planning for retirement, or monitoring your net worth over time. While the platform may not have the slickest interface, its functionality and depth more than make up for it.

Whether you opt for Quicken Classic or Simplifi, you’re getting decades of development, strong security, and a platform designed to handle complex finances with clarity.

FAQ

Yes. Both Quicken Classic and Simplifi have companion mobile apps for iOS and Android.

Yes—especially the Business & Personal plan, which includes tools for invoicing, tracking accounts receivable, and monitoring rental property income

Yes. Quicken uses 256-bit encryption and allows two-factor authentication. It also complies with data protection regulations and partners with FDIC-backed banks when syncing bank accounts.

Yes, including bank, investment, and credit card accounts.

Yes. All Quicken plans come with a 30-day satisfaction guarantee.