ALERT: Are you a U.S. citizen? If not, then you will unfortunately not be able to sign up for a Robinhood account. CLICK HERE TO LEARN ABOUT OUR #1 RECOMMENDED BROKER FOR NON-U.S. CUSTOMERS!

Does investment and banking accounts and diversification and asset allocation sound complicated and intimidating?

Perhaps it does to you.

Or, perhaps you know this first-hand.

Whatever the case may be…

…we are here to change your outlook.

3 Investing Tips to Begin your Journey

We offer three strategic thoughts to have in mind when you first begin your expedition into the wide world of investing!

Think long-term.

Investing is not about “getting in” at the right time.

The best investors don’t even try to predict the market.

Why?

Because it’s not possible!

Well, not without a crystal ball, anyway.

Instead, you need to focus on what you can control.

This means buying and holding quality investments.

In general, the stock market trends upward over time.

What does this mean for you?

Don’t sweat the ups and downs of the market…

…simply enjoy the ride!

Invest regularly.

Life is all about consistency.

You don’t need thousands of dollars to start investing.

Instead, simply commit to investing an amount you can afford – regularly.

These small investments add up to large investments over time.

So, when it comes to reaching your financial goals, consistency is key.

Stay diversified.

Investing doesn’t need to be risky.

But investing comes with inherent risk.

To reduce this risk, you must diversify!

Therefore, you should strive for a mix of stocks and funds.

Ever heard the saying, “Don’t put all your eggs in one basket!”

That is especially true when it comes to investing.

It also remains true making sure your choice of investment platforms are regulated by the likes of the SEC or SIPC.

If you follow these 3 steps, you will be on your way to riches in no time.

So, what are your barriers to investing?

Barriers can differ from one investor to the next.

However, every new investor faces these two challenges:

- The barrier of entry is too high (e.g., expensive!); and

- The idea of investing is, well, HARD!

For example, you turn on CNBC to find millionaires speaking in what seems like a foreign language.

And you say, “Nope, nope, and hell nope” – then you switch to something more interesting (Game of Thrones, anyone?).

Fortunately, technology has eliminated these two problems.

Today, numerous options are accessible and easily understood by all investors.

Unfortunately, with every solution, there is a new problem.

What is that problem?

There are TOO MANY options to choose from.

This is what we call “paralysis by analysis.”

You want to act, but you have no clue where to start.

Well, we are here to REMOVE your final EXCUSE for not investing.

That is right – we are bringing you two reliable investment options…

…and doing the analysis for you!

No need to thank us – we are happy to help.

The two brokers that we are here to discuss are Robinhood and Stash Invest.

Which is better? Which should you use? and how do they each treat client funds?

Take 5 minutes out of your “busy” day to find out!

Robinhood vs. Stash: Overview

Robinhood and Stash are both beginner friendly, simplistic investing platforms that take different approaches to their philosophies. We will give you a comprehensive run down of both below!

Robinhood Overview

Robinhood is one of the top new brokers in the industry.

So, what is all the hype about?

Most trading apps charge trade fees that add up significantly over time.

But with Robinhood, users can trade stocks, options, cryptocurrency, and exchange-traded funds (ETFs) for FREE.

Robinhood is shaking up the industry with its fee-free trading (and we love it).

Currently as of March 2025, the company boasts over 26 million users and counting.

To get started, follow these steps (it takes less than 5 minutes!):

- Download the app

- Enter your information

- Fund your account

- Start investing!

As Robinhood says…

…it’s time to “Do Money!”

How Do I Get up to $1,700 in FREE STOCK with Robinhood?

To open a Robinhood account, all you need is your name, address, and email. If you want to fund your account immediately, you will also need your bank account routing and account number.

As its current promotion, Robinhood will immediately give you FREE MONEY (between $5 and $200) to invest in a set list of stocks when you open a new account if you click on the promo image below. Then, once your account is open, you will be given your unique referral link. You will receive more free investing money (again valued at $5 to $200) for each person you refer. The more people you refer, the more you get up to a max of $1,500 a year. Click on this promo below to start your Robinhood account application and get your first stock for free.....

Bonus Tip: Use this link to get free investing money ($5-$200) when you open and fund your account with at least $10: sign up for Robinhood today, you'll get a deposit to your Robinhood account between $5 and $200. You can invest this money in stocks of your choosing from a list of 20 stocks. FURTHERMORE, for each friend that you refer, you will receive MORE free investing money up to $200. This is perfectly legit and you WILL get more free shares for every friend or family member you refer.

Why do they give away so much free stock? Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! They WANT you to refer friends!

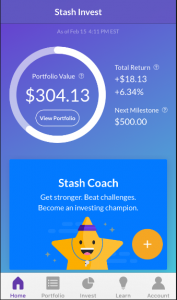

Stash Overview

Have you been searching for an investment app?

If so, you will want to know about Stash.

Stash is a registered investment advisor that makes investing easy for all.

But what is so important about being registered?

It means that Stash must act in YOUR best interest when advising you on your investments.

When you sign up, you will answer questions to determine two things:

- Investment Goals

- Risk Tolerance

From there, the app makes suggestions from over 90 exchange-traded funds (ETFs), as of March 2025.

These ETFs are set in asset allocations that agree with your chosen theme.

The themes include options like “Clean and Green,” “Data Defenders,” and “Pacific Powerhouses.”

Each recommendation is personalized based on your risk profile, historical performance, and expense ratio.

These recommendations are great, but you make the final decision.

Stash also allows you to invest in fractional shares of stock.

What does this mean?

You can invest in companies like Amazon ($1,700+), Apple ($230+), and Google ($1,200+) without buying an entire share.

That’s right – all you need is $5 to start investing.

To get started, follow these steps (in less than 5 minutes!):

- Download the app (takes less than a minute)

- Enter your information

- Link your bank account

- Start Stash-ing!

It is time to invest…

…the “Stash Way!”

Robinhood vs. Stash: Investment Options

Both Robinhood and Stash offer investors a multitude of different options. Robinhood tends to give investors full freedom of individual choice, while Stash often provides customize tailored portfolios.

Robinhood Investment Options

Robinhood supports stock, option, and cryptocurrency trading.

Stocks

If you didn’t already know…

…you can trade stocks on Robinhood.

In fact, you can invest in over 23,000 stocks on Robinhood in March 2025, including most U.S. equities and ETFs.

The company also trades over 650 global stocks not listed on American exchanges.

Even better, the Robinhood platform supports the following:

- Market orders

- Limit orders

- Stop-limit orders

- Stop orders

You can set these options to “good-for-the-day” or “good-till canceled” parameters.

With all these options, you are bound to find something worthwhile.

And keep in mind…

…all stock trades are 100% free on Robinhood.

Options

You can trade options with Robinhood.

The Options Contracts are for U.S. exchange-listed stocks and ETFs.

With Robinhood, you can access no-fee contacts, including:

- No commissions

- No per-contract fees

- Zero exercise fees

- Zero fee assignments

In addition to the above, you can use filters and access advanced trading strategies.

You can trade in single order or monitor complex contracts all at once.

Trading options is free with Robinhood (which can really boost your margins).

Cryptocurrency

If you are not into stocks and options…

…you can invest in cryptocurrency, including Bitcoin and Ethereum.

Other crypto options include:

Dogecoin (DOGE)

Solana (SOL)

Cardano (ADA)

XRP (XRP)

Pepe (PEPE)

Shiba Inu (SHIB)

Aave (AAVE)

Avalanche (AVAX)

Chainlink (LINK)

Litecoin (LTC)

Bonk (BONK)

Arbitrum (ARB)

Polygon (MATIC)

Optimism (OP)

Base (BASE)

- Official Trump (Trump)

You can trade all cryptocurrencies 24 hours a day, 7 days a week.

Whether you can access this feature depends on your location.

Currently, about half of the United States can access cryptocurrency trading.

However, you can still access price and market data on 16 cryptocurrencies.

Are you the next Bitcoin millionaire?

You will never know unless you try.

And, as always, your cryptocurrency trades are free.

Stash Investment Options

Stash supports stock and ETF trading.

One cool feature of Stash is that it offers thematic investing options.

You can invest in fractional shares of stock and ETFs.

Stocks

You can invest in fractional shares of companies you know.

These companies include names like Snapchat (SNAP), AMC Theaters (AMC), and Best Buy (BBY).

Each stock includes a brief summary, which makes investing very intuitive.

For example, the Shake Shack (SHAK) summary states (via stashinvest.com):

This popular restaurant chain operates “roadside” burger stands serving classic American food and drink.

All stock trades on Stash are commission-free (but monthly account charges apply).

Exchange-Traded Funds (ETFs)

You can invest in fractional shares of “themed funds.”

These funds bundle securities like stocks, bonds, and/or commodities.

Again, these investments are very intuitive and easy to understand.

For example, the Blue Chips fund provides:

Rely on the superstars that already made it big. Buy some of America’s most well-known companies.

These themed investments make investing more simple, relatable, and possibly even fun.

The ETF categories include the following:

- Bonds

- Commodities

- Consumer Discretionary

- Foundations

- Global Exposure

- Goods and Services

- Missions and Causes

- Strategies and Experts

- Technology and Innovation

The possibilities are endless!

Robinhood vs. Stash: Accounts

Both platforms offer a number of different account options that allow investors to choose based on their own individual financial circumstances, planning, and needs.

Robinhood Accounts

Robinhood offers a number of account types and services as of March 2025.

Robinhood Instant

The default account type for new users upon sign-up.

Key Features:

Instant Deposits: Immediate access to funds for trading.

Extended-Hours Trading: Ability to trade stocks during pre-market and after-market sessions.

Robinhood Gold

An upgraded version of Robinhood Instant, available for a monthly fee.

Key Features

Increased Buying Power: Access to margin for larger trades.

Larger Instant Deposits: Higher deposit limits, allowing for larger trades without delay.

Premium Research Tools: Access to advanced market data and research to inform your trading decisions.

Monthly Fee: $5 per month.

Robinhood Cash

A non-margin account that allows users to trade only with settled funds.

Key Features:

- Commission-Free Trades: Place trades without paying commissions during both standard and extended-hour sessions.

- No Margin Trading: Only settled funds can be used for transactions.

Robinhood Traditional IRA

A tax-deferred retirement account where contributions may be deductible, and taxes are paid upon withdrawal during retirement.

Key Features:

- Contribution Limits: $6,000 for those under 50; $7,000 for those over 50 (2024 tax year).

- Investment Options: Access to a wide range of stocks and ETFs.

- Matching Contributions: Robinhood offers a 1% match, and Robinhood Gold subscribers can earn up to a 3% match.

- Tax Benefits: Contributions are tax-deductible, and taxes are paid on withdrawals during retirement.

Robinhood Roth IRA

A retirement account where contributions are made with after-tax dollars, and qualified withdrawals are tax-free.

Key Features:

- Contribution Limits: Same as the Traditional IRA.

- Income Eligibility: Contributions are subject to income limits.

- Investment Options: Access to stocks and ETFs.

- Matching Contributions: Same matching structure as the Traditional IRA.

Robinhood Strategies

A wealth management service offering professionally managed portfolios tailored to your investment goals.

Key Features:

- Expert Management: Portfolios curated by professional investors.

- Affordable Fees: 0.25% annual fee on assets, capped at $250 for Robinhood Gold members.

- Availability: Launched on March 26, 2025, and available to Robinhood Gold members with plans for broader availability in April 2025.

Robinhood Cortex

An AI-powered investment tool designed to provide real-time market insights and trade suggestions.

Key Features:

- Market Insights: In-depth analysis of market trends and stock performance.

- AI-Generated Trade Suggestions: Recommendations based on real-time market data.

- Availability: Launched on March 26, 2025, for Robinhood Gold members, with plans for wider access later in 2025.

Robinhood Banking (Coming Soon)

A new banking platform offering checking and savings accounts with competitive features.

Key Features:

- 4% APY: High annual percentage yield on savings balances.

- FDIC Insurance: Coverage up to $2.5 million through partner banks.

- Cash Delivery Service: Physical cash delivery to users’ doorsteps.

- Availability: Scheduled for release in the fall of 2025.

Stash Accounts

Stash Personal Brokerage Account

A standard taxable investment account allowing users to buy and sell stocks and ETFs.

Key Features:

- Invest in Stocks and ETFs: Access to a wide range of individual stocks and exchange-traded funds.

- Fractional Shares: Invest with as little as $5 in fractional shares.

- No Minimum Balance: No minimum required to start investing.

- Flexible Investment Options: Freedom to manage and modify your portfolio with ease.

Stash Retirement Accounts (Traditional & Roth IRA)

Tax-advantaged accounts designed for long-term savings.

Key Features:

- Contribution Limits: $6,000 for those under 50; $7,000 for those over 50 (2024 tax year).

- Investment Options: Access to a broad range of stocks and ETFs.

- Tax Benefits: Contributions to a Traditional IRA are tax-deductible, while Roth IRA withdrawals are tax-free after retirement.

- Matching Contributions: 1% match on contributions, with higher matches for Stash+ subscribers.

Stash Smart Portfolio

An automated investment account using robo-advisory services to build and manage a diversified portfolio based on your goals.

Key Features:

- Automated Management: Robo-advisors handle your portfolio and rebalance it periodically.

- Diversification: Portfolios are diversified across asset classes for balanced risk.

- Low Fees: Competitive fees compared to traditional financial advisors.

- Tailored to Goals: Portfolios are designed based on your investment goals and risk tolerance.

Stash Custodial Account

An account set up by an adult for the benefit of a minor, allowing parents or guardians to invest on behalf of their children.

Key Features:

- Control Until Majority Age: Funds are managed by the custodian until the minor reaches the age of majority.

- Investment Options: Same as the personal brokerage account, including stocks, ETFs, and fractional shares.

- Flexible Usage: Funds can be used for the child’s benefit, such as education costs.

Stash Bank Account

A banking account offering features like a debit card, direct deposit, and the ability to earn stock rewards on purchases.

Key Features:

- Stock-Back® Rewards: Earn stock rewards on eligible purchases made with the Stash debit card.

- Direct Deposit: Ability to set up direct deposit for faster access to funds.

- No Fees: No monthly maintenance fees, with easy access to funds through the Stash app.

Stash+ Account

A premium subscription plan that includes all the features of a standard Stash account, plus additional benefits for more advanced investing.

Key Features:

- Enhanced Stock-Back® Rewards: 1% back on eligible purchases made with the Stash debit card.

- Custodial Accounts for Children: Create accounts for your kids and invest on their behalf.

- Financial Tools: Additional financial resources, including access to financial advisors and tools for goal setting.

- Monthly Fee: $9 per month.

Robinhood vs. Stash: Similar Features

Both platforms have a number of features (that we love) in common!

Stock and ETF Trading:

Both Robinhood and Stash provide access to stock and ETF trading. They each offer a broad selection of assets, giving users a variety of options for building a diverse portfolio. While Robinhood is known for its commission-free trading and real-time market access, Stash also offers a solid variety of stocks and ETFs with the added benefit of fractional shares, making investing accessible for all levels of investors.

Fractional Shares

Both Robinhood and Stash allow users to purchase stocks through fractional shares. This feature is beneficial for those who want to invest in high-priced stocks without needing to buy a whole share. With fractional shares, you can start investing with as little as $5, enabling users to diversify their portfolios even with limited funds. This feature is ideal for new investors who want to invest in the companies they believe in without making a large financial commitment.

Low Minimum Balance Requirements

There is no minimum balance requirement on Robinhood, allowing you to start investing with any amount. Stash, on the other hand, has a $5 minimum balance requirement for its personal brokerage accounts. However, this difference is essentially negligible, as both platforms allow users to begin investing with a small amount of capital. Whether you’re starting with $5 or $0, both Robinhood and Stash eliminate the barriers to entry that often make investing seem intimidating.

Education

Both platforms offer educational resources to help users make informed decisions. Robinhood features Robinhood Learn, an extensive library of articles, videos, and tutorials designed to teach investors the basics of the stock market and trading. Similarly, Stash offers Stash Learn, which provides easy-to-understand articles and courses on investment principles, portfolio management, and the basics of finance. These resources are invaluable for beginners and are great for anyone looking to expand their knowledge in the world of investing.

Both Robinhood and Stash offer powerful tools for new and experienced investors alike. From fractional shares to educational resources, each platform brings something unique to the table, helping you start investing with ease and confidence.

Pro Tip:

Get a free stock with Robinhood, or get started with a tailored Stash portfolio today!

Robinhood vs. Stash: Unique Features

Both Robinhood and Stash have a number of interesting features and account types for beginners that set them apart from traditional brokerages.

Robinhood Unique Features

Robinhood in particular has taken the traditional brokerage world by storm offering a number of easy to access features for free.

Commission-free trading

Robinhood offers commission-free trading on all of its transactions. There are no fees for trades, allowing you to invest without worrying about extra costs on individual taxable accounts. While Stash does not technically charge commission fees, it does have account fees for some types of accounts, which makes Robinhood’s commission-free trading a big advantage, especially for investors with limited funds.

Trading tools

Robinhood provides a minimalistic yet useful set of trading tools, including watch lists, stock charts, and price alerts. These features help you keep track of your investments and monitor changes in the market, even though the platform is less feature-rich compared to other brokers. Stash, on the other hand, does not provide tools to analyze investments or track market trends.

Stash Unique Features

Stash has a number of unique features that allow many beginner investors to “set it and forget it” in many customizable formats.

Intuitive investment options

Stash makes it easy for users to understand where their money is going by cutting through the complex financial jargon often associated with investing. This simplicity makes it accessible to beginners who may feel overwhelmed by traditional investing platforms like Robinhood. Robinhood, by contrast, is closer to a “traditional” brokerage with a more complex interface that may not be as user-friendly for new investors.

Retirement accounts

Stash offers both Traditional and Roth IRAs, providing users with valuable tax benefits to help save for retirement. These accounts are essential for long-term financial planning, and the tax advantages make them an attractive option for investors focused on saving for the future. Robinhood does not currently offer retirement accounts, so Stash’s retirement account options are a significant benefit for users who want to plan for retirement in a tax-advantaged way.

Robinhood vs. Stash: Minimum Deposit, Commissions, and Fees

Both Stash and Robinhood differ slightly in cost, despite both being beginner friendly, cheap, accessible platforms.

Robinhood Fees

Robinhood requires no minimum deposit to open an account. While trades are commission-free, there are minor regulatory fees imposed by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). The SEC fee is $13.00 per $1,000,000 of principal, and the FINRA Trading Activity Fee (TAF) is $0.000166 per share for equity sales and $0.00279 per contract for options sales.

In addition, Robinhood offers a premium account, Robinhood Gold, which provides features like increased buying power, larger instant deposits, and premium research tools for $5 per month. Subscribing to Robinhood Gold is optional and not required for standard trading.

Stash Fees

Stash requires a minimum deposit of $5 to open an account. Stash offers three subscription plans: Beginner ($1 per month), Growth ($3 per month), and Stash+ ($9 per month). Each plan includes access to investment accounts, with higher-tier plans offering additional features like custodial accounts and increased Stock-Back® rewards.

In addition to the subscription fees, Stash users may incur standard fees and expenses related to ETFs and other investment services. These are typically disclosed in the platform’s Advisory Agreement and Deposit Account Agreement.

Clarification on Regulatory Fees

Both Robinhood and Stash are required to collect regulatory fees on behalf of regulatory bodies, such as the SEC and FINRA. These fees are passed on to users and are not part of the platforms’ revenue. It’s important to review the specific fee schedules from each platform, as they may vary.

Summary

Robinhood offers commission-free trading with no minimum deposit and optional premium features through Robinhood Gold for $5 per month. Stash, on the other hand, requires a $5 minimum deposit and provides subscription plans starting at $1 per month, with additional fees for certain services and investments. Both platforms have distinct fee structures, so it’s important to review their official resources for the most accurate and up-to-date cost information.

Robinhood vs. Stash: Accessibility

Both Robinhood and Stash are available for download on iOS and Android smartphones, providing users with easy access to their investments. As long as you have internet connectivity, you can manage your investments from anywhere.

Originally launched as mobile-only platforms, both apps have since expanded to include web-based versions. This means that if you don’t have access to a phone, you can still access your investments through your desktop or laptop. Whether you’re on the go or at home, both platforms make it simple to stay connected to your portfolio.

Robinhood vs. Stash: Which is better?

And the winner is…

…Robinhood!

How Do I Get up to $1,700 in FREE STOCK with Robinhood?

To open a Robinhood account, all you need is your name, address, and email. If you want to fund your account immediately, you will also need your bank account routing and account number.

As its current promotion, Robinhood will immediately give you FREE MONEY (between $5 and $200) to invest in a set list of stocks when you open a new account if you click on the promo image below. Then, once your account is open, you will be given your unique referral link. You will receive more free investing money (again valued at $5 to $200) for each person you refer. The more people you refer, the more you get up to a max of $1,500 a year. Click on this promo below to start your Robinhood account application and get your first stock for free.....

Bonus Tip: Use this link to get free investing money ($5-$200) when you open and fund your account with at least $10: sign up for Robinhood today, you'll get a deposit to your Robinhood account between $5 and $200. You can invest this money in stocks of your choosing from a list of 20 stocks. FURTHERMORE, for each friend that you refer, you will receive MORE free investing money up to $200. This is perfectly legit and you WILL get more free shares for every friend or family member you refer.

Why do they give away so much free stock? Because they spend their advertising dollars this way instead of buying TV, radio, print, or online ads! They WANT you to refer friends!

Robinhood gets the nod here primarily because of the money-saving opportunity.

The account fees that Stash imposes can be significant for new investors.

If you are a new investor with $100 to invest, even $1 per month is huge.

For example, if you earn an annual 7% return on your investment, you will LOSE $5 the first year.

The monthly charges sound small, but they will eat at your return on investment.

On the other hand, you can take advantage of fee-free trading with Robinhood.

At the end of the day, you must decide which option is better for you.

If you want access to retirement accounts, enjoy intuitiveness, or want to invest in bonds…

…Stash may be the best option for you.

The above reasons are just a few examples of why you may choose Stash over Robinhood.

However, both apps are worth checking out.

Have you tried either of these apps?

Which app do you like better, and why?

Let us know with a comment below!

If you are intrigued by Stash and want to know more, check out our 2025 STASH REVIEW!