Acorns and Stash are micro-investment apps that make investing easy for everyone, and luckily both are regulated by the SEC!

It is 2025, and the power of technology has made investing easy, intuitive, and flexible.

These apps create personalized investment portfolios by regularly saving and investing small amounts of money.

These amounts are small enough to go undetected by the average user but can add up in a major way over time.

The only problem is deciding which app to choose.

There is Acorns, Stash, and many more apps being created every single day.

With this in mind, paralysis by analysis is a very real thing for investors.

But if this is your excuse for not investing…

…you no longer have that excuse!

Because we are here today to tell you which investment app to choose. Sound good?

Acorns vs. Stash: Overview

Stash Overview

If you are looking for financial opportunity…

…look no further!

Because Stash Invest provides financial opportunity to all.

The company offers an investment app (and website) where you can invest as little as $5 to start.

Stash offers investment recommendations but leaves the investing part entirely up to you.

Your investment account portfolio can be designed based on investment themes, which are created with various exchange-traded funds (ETFs).

These ETFs are set in asset allocations that agree with your chosen theme.

The themes include options like Clean and Green, Data Defenders, Pacific Powerhouses, and many more.

To get started, follow these steps:

- Download the app (takes less than a minute)

- Link your bank account

- Start Stash-ing!

Acorns Overview

Acorns seeks to look after the financial best interest of the up-and-coming.

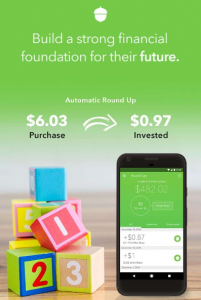

This app provides a unique opportunity to invest your “spare change” in an investment account.

That’s right, simply connect your mobile phone to your financial accounts, and Acorns will invest your spare change.

You can link as many bank accounts, debit cards, and credits as you need.

The process is relatively straightforward, but let’s check out an example:

Let’s say you purchase a coffee for $2.50.

Your total purchase will round up to $3.

From there, the additional $0.50 will go straight to your investment accounts.

Therefore, you can invest money with little effort and without even noticing.

To get started, follow these steps:

- Download the app (again, takes less than a minute)

- Link your bank account

- Start spending!

Minimum Deposit, Commissions, and Fees

Stash Fees

Stash requires a minimum deposit of $5 to open an account. For users under the age of 25, Stash offers fee-free access to retirement accounts, including Traditional and Roth IRAs.

After the first month, Stash offers two subscription plans:

- Stash Growth ($3/month): This plan includes a personal investment account, the Stock-Back® Card, saving tools, personalized advice, a Roth or Traditional retirement account (IRA), and an automated investing account (Smart Portfolio).

- Stash+ ($9/month): This plan includes all features of Stash Growth, plus Custodial Accounts for children, increased Stock-Back® rewards, and other premium features.

It’s important to note that, in addition to the subscription fee, users may incur standard fees and expenses reflected in the pricing of ETFs, as well as fees for various ancillary services charged by Stash and its custodians. For detailed information, please refer to Stash’s Advisory Agreement and Deposit Account Agreement.

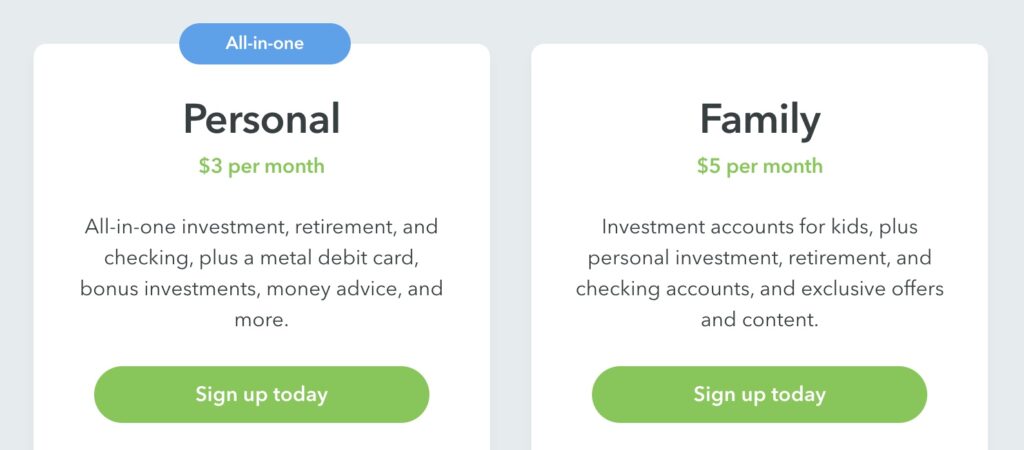

Acorns Fees

Pro Tip:

Start saving with the Acorns Round Up feature, or Get a tailored, expert portfolio with Stash today!

Account Minimums

Acorns does not require a minimum deposit to open an account. However, to begin investing, you’ll need to fund your account with at least $5.

Subscription Plans and Fees

Acorns offers three subscription plans, each with a flat monthly fee that includes access to various services:

- Bronze ($3/month): Includes Acorns Invest (Base Portfolio), Acorns Later (Retirement Account), and Acorns Checking.

- Silver ($6/month): Includes all Bronze features plus Acorns Invest (Custom Portfolio) and premium educational content.

- Gold ($12/month): Includes all Silver features plus Acorns Early (Investing for Kids), a 3% match on IRA contributions, and access to the Acorns Benefits Hub.

Each plan’s monthly fee covers all account management services, and there are no additional asset-based fees for accounts under $1 million.

Additional Fees

Acorns does not charge transaction fees, commissions, or fees based on assets for accounts under $1 million. However, users may incur fees for optional services or features not included in their subscription plan.

Summary of Fees

To start investing with Acorns, a minimum of $5 is required. The platform’s subscription fees are straightforward, with no minimum balance requirements or additional asset-based fees for standard accounts. It’s important to review each plan’s features to determine which aligns best with your financial goals.

Portfolios

Both companies offer unique, modern, adaptable approaches to portfolio building for beginners!

Acorns Portfolios

Acorns uses your financial information and investment objectives to suggest a portfolio that aligns with your goals. These goals can range from long-term growth and short-term savings to major purchases, family-related expenses, or general wealth accumulation.

Based on your responses, along with factors like age and income, Acorns recommends a portfolio tailored to your risk tolerance, which can be categorized as:

- Conservative

- Moderate Conservative

- Moderate

- Moderately Aggressive

- Aggressive

Acorns offers a selection of Exchange-Traded Funds (ETFs) to build diversified portfolios. These ETFs encompass various asset classes, including large-cap and small-cap stocks, international markets, emerging markets, real estate, corporate bonds, and government bonds.

By investing in these ETFs, you gain exposure to a broad range of securities, which can help mitigate risk and enhance potential returns.

Pro Tip:

Start saving with the Acorns Round Up feature, or Get a tailored, expert portfolio with Stash today!

Available ETFs through Acorns:

- Large Company Stocks: Vanguard S&P 500 ETF (VOO)

- Small Company Stocks: Vanguard Small-Cap ETF (VB)

- Developed Markets: Vanguard FTSE Developed Markets ETF (VEA)

- Emerging Markets: Vanguard FTSE Emerging Markets ETF (VWO)

- Real Estate: Vanguard REIT ETF (VNQ)

- Corporate Bonds: iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- Government Bonds: iShares 1-3 Year Treasury Bond ETF (SHY)

These ETFs are managed by reputable investment firms such as Vanguard and BlackRock, ensuring professional management and diversified exposure to various markets and asset classes. This diversified approach aims to balance potential risks and returns, aligning with your specified investment goals and risk tolerance.

Stash Portfolios

Stash offers a personalized investing experience by guiding users through a risk tolerance questionnaire during the account setup process.

This assessment considers factors such as age, investment goals, and time horizon to tailor investment recommendations that align with your financial objectives. Based on your responses, Stash provides a range of investment options that correspond to varying levels of risk tolerance, from conservative to aggressive.

It’s important to understand that Stash presents a curated list of investment options for you to choose from, ensuring that your selections align with your comfort level regarding investment risk.

Stash offers a diverse array of investment assets, including over 70 individual stocks and more than 90 ETFs. This extensive selection allows you to build a portfolio that reflects your personal interests and investment preferences, all while maintaining alignment with your identified risk tolerance.

Features

Both platforms offer a number of streamlined, compelling features for new investors.

Acorns Features

Acorns is a financial technology company that simplifies investing by offering several features designed to help users save and invest effortlessly.

Round-Ups®

Acorns’ Round-Ups® feature allows you to invest spare change from everyday debit card purchases. When you make a purchase, Acorns rounds up the amount to the nearest dollar and invests the difference into your chosen portfolio. For example, if you buy a coffee for $3.25, Acorns will round up $0.75 and invest it on your behalf.

Acorns Later

Acorns Later is a retirement savings account that helps you plan for the future with minimal effort. The platform recommends the most suitable Individual Retirement Account (IRA) based on your financial situation and goals, making it easier to start saving for retirement.

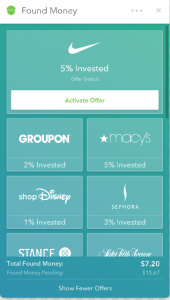

Found Money

Found Money is a feature that rewards you for shopping with Acorns’ partner brands. When you make a purchase with a participating retailer, Acorns invests a percentage of your purchase amount back into your account. For instance, shopping at Apple might earn you a 5% investment bonus.

Acorns Spend

Acorns Spend offers a checking account paired with a debit card that not only facilitates everyday transactions but also automates saving and investing. With Acorns Spend, you can set up automatic transfers to your investment account, ensuring consistent growth of your savings.

These features collectively aim to make investing accessible and straightforward, helping you build a secure financial future with minimal effort.

Stash Features

Stash has a number of interesting features and account types for investors looking to park their hard earned money in a simplistic, but strategically tailored fashion.

Stash Retire

Stash provides retirement accounts, including Traditional and Roth IRAs, tailored to your financial goals. The platform assists you in selecting the most suitable account based on your individual circumstances, aiming to maximize your tax savings both now and in the future. It’s important to note that while Stash offers guidance, consulting with a tax professional can provide personalized advice aligned with your specific tax needs.

Custodial Account

Stash allows individuals over the age of 18 to open custodial accounts for minors. This feature enables parents and guardians to invest on behalf of their children, fostering early financial literacy and providing a head start on wealth building.

Stash Banking

Stash’s banking services are designed to enhance your financial flexibility and rewards. Key features include:

- Cash Back Rewards: Earn up to 1% back in stock on eligible purchases with the Stock-Back® Card. Stash also offers promotional bonuses, such as up to 3% back at selected merchants.

- Fee-Free ATMs: Access over 55,000 fee-free ATMs worldwide, ensuring convenient and cost-effective access to your funds.

- No Hidden Fees: Enjoy banking services without overdraft fees, minimum balance requirements, monthly maintenance fees, or setup fees, allowing you to keep more of your money.

These features collectively aim to provide a comprehensive financial ecosystem, supporting your investment, retirement, and everyday banking needs with transparency and user-centric benefits.

Pro Tip:

Start saving with the Acorns Round Up feature, or Get a tailored, expert portfolio with Stash today!

Accessibility

You can download both apps on iOS and Android smartphones.

If you have connectivity, you have access to your investments.

Both apps began as mobile-only offerings, but have gone on to include web-based platforms.

If for some reason, you do not have a phone, you can hop on your desktop to access your investments.

Humans Advice

Neither Stash or Acorns offer human advisors.

Both apps are focused on low-cost investing, so do not expect much handholding.

Fortunately, these apps are designed to be user-friendly, and this helps keep the costs down.

Similar Features

You may realize that these two apps are strikingly similar in many ways.

And you are correct.

For example, both apps give you the freedom to invest as little as you want.

Investing small amounts frequently will enable you to accumulate an investment portfolio with minimal effort.

You will not even realize that you are saving money!

Additionally, both platforms have mobile apps that enable you to invest on the go.

Lastly, both companies offer investment management and have the similar fee structures.

Unique Features

Both Acorns and Stash have a number of unique features that set them a part from many beginner-based investor friendly platforms.

Acorns Unique Features

- Web and Mobile Access: Acorns provides both mobile and desktop platforms, allowing you to manage your investments seamlessly across devices.

- Found Money: Acorns partners with over 200 brands to offer cashback rewards when you make purchases with participating retailers. A percentage of your purchase is automatically invested into your Acorns account, helping you grow your savings effortlessly.

- Acorns Later Match: As of March 2025, Acorns introduced the Later Match feature, offering a 3% IRA match for Acorns Gold subscribers and a 1% match for Acorns Silver subscribers on new contributions to Acorns Later accounts during the first subscription year.

Stash Unique Features

- Auto-Stash: Stash’s Auto-Stash feature allows you to set up automatic investments on a daily, weekly, bi-weekly, or monthly basis. This “set it and forget it” approach helps you build your investment portfolio consistently without manual intervention.

- Stash Learn: Stash offers a comprehensive educational platform, Stash Learn, providing articles, guides, and tips to enhance your investment knowledge directly within the app.

Which is better?

And the winner is…

Yes, Acorns wins by a slight margin. Here is why…

Acorns and Stash both offer low-cost investment accounts.

Acorns is overall cheaper, but Stash offers a broader range of ETFs and includes individual stocks.

But the money you save in fees can be invested for the future, which can be a significant factor in total returns over time.

Acorns is simple and offers more useful investment tools, such as Roundups.

Roundups make investing much easier with your online banking account because you do not even realize the money is gone.

Now, we do believe Stash Invest account offers value to investors, as well.

The company makes investing intuitive by creating portfolios for specific purposes, instead of choosing to actively manage client funds.

We love this feature because you can understand what you are supporting without analyzing the underlying stocks.

So, if you HAD to choose one app, sign-up for Acorns.

But why would this ever be the case? You can undoubtedly download and try both Acorns AND Stash!

So, go ahead and sign-up for Stash here.

Which app do you like better between Acorns vs Stash, and why?

If you are intrigued by Stash and want to know more, check out our 2025 Stash Review!

Let us know with a comment below and remember investing involves risk, no matter the type!

FAQ

If you want to help your kids build money skills early on (and maybe stop asking for $10 every five minutes), Acorns Early could be a solid move. It’s not a full-on investment account like a UGMA or UTMA—but it does give you tools like a kid-friendly debit card, chore and allowance features, and financial education designed for families. TL;DR: It’s more about learning money than investing it—for now.

Acorns Early is a family-focused money app built to teach kids financial responsibility from the ground up. You’ll get a debit card for your kid, tools for setting up chore-based allowances, and a space for family and friends to send money as gifts. Think of it as a modern piggy bank that teaches real-world money skills. You manage it, they use it, and everyone learns along the way.

Not yet. Acorns Early doesn’t currently offer direct investing options for kids. Instead, it focuses on teaching smart money habits through spending, saving, and goal-setting tools. If your priority is building an investment portfolio for your child, you’d still need to explore traditional custodial brokerage accounts. But if you’re more interested in raising a financially confident kid? This is a strong place to start.