The world of finance and investing is one of high stakes and constant change.

Prices rise and fall, companies come and go.

Investing used to be the exclusive purview of small groups of pinstriped men with slicked-back hair and BMWs they paid for by selling junk stocks to rubes and charging exorbitant fees to manage the portfolios of the well-to-do.

Things started changing when the internet started looking less like a toy for nerds to play with and more like a game-changer.

E*Trade was the first of the digital self-serve brokerages.

It promised a service it couldn’t yet provide: to give regular Joes the ability to trade like Wall Streeters from anywhere in the world.

Traders and asset managers from Manhattan to San Francisco laughed and shook their heads. At first.

The Great Recession threw another Lehman Brothers-sized wrench into the financial machinery underpinning the economy.

A huge chunk of the professional investor class found themselves unceremoniously kicked to the curb over the course of a few short months.

An entire industry crumbled in the blink of an eye, but from the rubble rose something new.

And that’s where Benzinga comes in.

This Benzinga review will tell you how Benzinga changed the game.

The Who, the What, and the Why

Benzinga.com launched in 2010.

The site was the brainchild of a man named Jason Raznick, a prolific businessman and investor who saw an opportunity in the new class of independent investors that arose in the wake of the Great Recession.

Raznick recognized the need for real-time, in-depth financial news, actionable trading ideas, and analyst-quality information for new and newly independent investors.

He wanted to help independent investors navigate the markets with the same access and fluency as the traders still employed by the big banks and investing firms, and he envisioned a website that could provide everything an investor would need on one website.

And thus, Benzinga was born.

The Value Proposition

Benzinga has grown from a small financial outlet to a one-stop digital shop for all things finance.

In February of 2025, 11.94 million readers visited Benzinga’s website, drawn by Benzinga’s mix of original content, curated news feed, and wealth of investing ideas for everything from options to cryptocurrency and back.

Unlike some similar sites, Benzinga is more than willing to shift its focus in response to its users’ preferences.

When an asset class like crypto or NFTs rise in popularity, Benzinga responds by adding a whole new section on their front page with bespoke coverage from their writers supplemented by carefully curated content sourced from reputable sites around the net, ensuring that it curtails to investments and products that are well known and/or regulated by organizations such as the SEC.

Benzinga’s much-vaunted news feed—even the 100% free version you get without signing up for a subscription—is both wide and deep.

You can spend half of your day reading through the content on Benzinga’s front page alone, and that barely scratches the surface.

You want news about certain sectors or industries? Analysis and news coverage of specific companies? How about reports on company earnings, dividends, buybacks, management, and IPOs? How about mergers and acquisitions, legal issues, the implications of government policies, and even a bit of politics here and there?

Benzinga has you covered. And again, that’s only scratching the surface.

You can get started with Benzinga at absolutely no cost. If you do decide you want access to more advanced features, though, you might want to take a look at Benzinga Pro.

Pro Tip:

Receive a free Benzinga Research bonus report Buy These 3 Stocks in Trump’s First 100 Days when you sign up for Bezinga or Benzinga Pro today! Plus, you can get a 14-day FREE TRIAL when you sign up today!

Monitoring Markets

One of Benzinga’s biggest benefits is its expansive coverage of just about every market you can think of from all manner of altitudes and angles.

The site has a semi real-time ticker at the top of the page that tracks the biggest movers and most interesting trades of the day, plus a search bar that lets you find specific companies by name or stock symbol.

Speaking of specific companies, if you click on any of the tickers or search for a stock you’ll be taken to a page that’s absolutely packed with information on that company/security.

There are important statistics like the daily and 52-week range, with a chart that you can adjust to show the performance from as little as 1 day to as long as 10 years.

And yes, you can find a good bit of that info on Yahoo Finance or similar services, but Benzinga doesn’t stop at the surface level.

Each stock/security’s page has stats and charts, sure, but the real value comes from all the extras that Benzinga throws in for financial news and market data.

Each page has a collection of related news stories and press releases, a set of frequently asked questions, links to buy the stock or security, and lists of stock ideas and short interest provided by both analysts and community members that cover financial markets.

The fact that Benzinga provides all of this for free is incredibly impressive, to say the least.

Pro Tip:

Receive a free Benzinga Research bonus report Buy These 3 Stocks in Trump’s First 100 Days when you sign up for Bezinga or Benzinga Pro today! Plus, you can get a 14-day FREE TRIAL when you sign up today!

Investing Ideas

The real magic of the Investing Ideas section lies in how Benzinga caters to every type of trader, regardless of experience level or preferred asset class. Whether you’re a seasoned investor looking for technical setups or a newer trader still learning how to read price action, there’s something here to catch your eye—and potentially boost your bottom line from the latest market moving news.

For example, one of Benzinga’s strengths is how it incorporates real-time sentiment and trending narratives into its trade ideas. The Cramer-based ideas section doesn’t just track what the Mad Money host is saying; it contextualizes his opinions and breaks down whether his calls have historically led to over- or under-performance. It’s a surprisingly helpful tool for traders who want to fade or follow media-driven moves.

Similarly, the rumors page is essentially a curated list of market whispers—unconfirmed news, buyout chatter, product leaks—that might lead to short-term volatility. This is gold for momentum traders who live for fast-moving breakouts.

But there’s also a more disciplined, data-first side to the platform. The Technicals page dives deep into chart patterns, support and resistance zones, and trend analysis. It’s not a technical analysis school, but it does provide you with digestible ideas—think: “XYZ stock just broke its 200-day moving average” or “ABC just flashed a golden cross.” For people who trade based on indicators and price signals, this section is a daily must-check.

If you prefer the fundamentals, Benzinga’s Long Ideas and Short Ideas pages are where you’ll likely spend most of your time. These articles often come with commentary on earnings trends, valuation metrics, or broader macroeconomic angles that make a company more or less attractive. It’s not uncommon to see side-by-side analysis of competitors, updates on sector-specific challenges, or earnings previews that include what analysts expect to happen and what might surprise to the upside or downside.

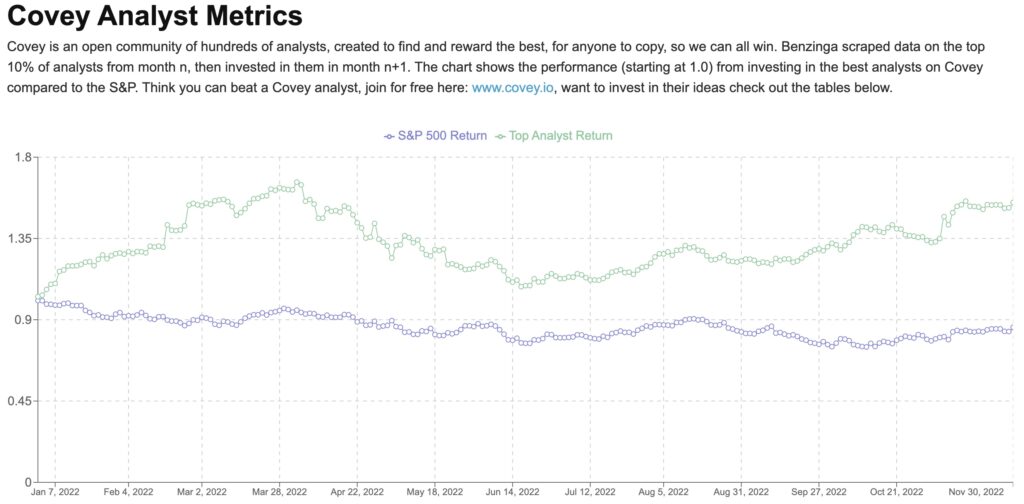

One feature that really helps Benzinga stand out is the Covey analyst leaderboard. Instead of generic “analyst ratings,” you get a glimpse into the actual trading activity of analysts who are outperforming the market. This crowdsourced data shows you who’s walking the walk—not just talking the talk—and what specific trades they’ve made recently. If you’ve ever wondered what successful traders are buying or shorting in real time, this is where to look.

Of course, Benzinga also curates lists for specific trading styles. The penny stocks list is updated frequently and is one of the most popular sections of the site. The ETFs and blue chip stock lists are a great resource for long-term investors who still want some fresh ideas without diving into speculative territory. Meanwhile, the swing trade ideas are perfect for traders who operate on a 3-10 day horizon and want setups that match their time frame.

Ultimately, Benzinga’s Investing Ideas section doesn’t just throw tickers at you—it creates a framework for thinking like a trader. You’ll find a balance of news, analysis, community insight, and expert commentary that can help shape your strategy, regardless of whether you’re buying dips, shorting rallies, or just trying to stay informed in a noisy market.

And perhaps what makes it all the more accessible is that Benzinga doesn’t try to overcomplicate things when it comes to stock news. Benzinga research is fast, digestible, and refreshingly free of the jargon that often clutters traditional financial media. You won’t need to read a 40-page analyst report to get the gist of why a stock is trending or why a specific trade setup looks attractive. Most ideas come with just enough context to help you act, but not so much fluff that you’re left sifting through noise.

Whether you’re checking in daily for swing setups, scanning for short ideas, or simply keeping tabs on the top-performing analysts, the Investing Ideas section acts like a launchpad—giving you options, not orders. It’s not about giving you the answer; it’s about helping you ask smarter questions. And in a market where confidence comes from clarity, that kind of support can be a game-changer in a news service.

Pro Tip:

Receive a free Benzinga Research bonus report Buy These 3 Stocks in Trump’s First 100 Days when you sign up for Bezinga or Benzinga Pro today! Plus, you can get a 14-day FREE TRIAL when you sign up today!

Finance Gets Personal

The last free services that Benzinga offers are a collection of options for comparing stocks, forex, bonds, etc. brokers, lists of top stocks, offers for all kinds of insurance, and links to help you find a mortgage broker.

There’s even a list of alternative investment pages that help you get into investing in things like art, gold, watches, real estate, and land.

One-stop shop indeed that even has stock charts.

You can get started with Benzinga absolutely free. If you decide you want access to the platform’s next-level market news, stock screeners, options alerts, and more, then Benzinga Pro might be a great choice for you.

Benzinga Pro comes with three subscription tiers:

- Basic Plan: $37 per month

- Streamlined Plan: $147 per month

- Essential Plan: $197 per month

With the essential plan, you get a free subscription to the Options Trading Newsletter after three months, and a free subscription to the Enhanced Options Trading Newsletter after your sixth month as a subscriber.

You can read our full review on Benzinga Pro here.

The Verdict

As our review has shown…Benzinga is awesome.

The sheer amount of content, information, analysis, and investing ideas dwarf most other similar services out there, and all without spending a dime on a subscription.

It doesn’t matter if you’re a newbie or a veteran, Benzinga has something to offer you that you can’t find anywhere else.

It may be the exclusive coverage. Or the broad range of subject matter. Or the strength of the analysis that Benzinga gets from its partners.

Whatever the case, you should give it a shot. It’ll be worth your time. Click here to register for Benzinga!