When Block, Inc. (formerly Square Inc.) launched Cash App in 2013, it was a minimal tool for peer-to-peer transfers. Today, it’s grown into a full financial services platform offering banking, investing, crypto, tax filing, and more.

But how does Cash App stack up in 2025? Is it still one of the best ways to send and receive money, save money, or start your investing journey?

This review breaks it all down with fresh data, updated features, and insights into how Cash App users are making the most of it now.

What Is Cash App? (And How to Use It)

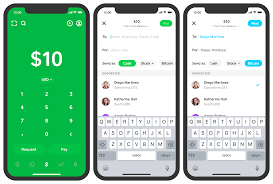

Cash App is a mobile app that lets you send money, receive money, buy Bitcoin and stocks, file taxes, and access basic banking services provided through its bank partner, Sutton Bank. Though it’s not a bank, it functions like one for many users.

To download Cash App, just head to the App Store or Google Play and create a Cash App account using your phone number or email. From there, you can link a bank account, add a debit card, or fund your account directly with direct deposit.

If you’ve ever wondered how to use Cash App, it really couldn’t be simpler. Once your account is set up, you can easily send or request money using someone’s $Cashtag, phone number, or email. You can also generate or scan a QR code for in-person payments—no need to deal with cash or cards.

Pro Tip:

When you sign up for Cash App and refer your friends, you get a CASH bonus deposited to your Cash App account.

The Cash App Card: Physical Cash Meets Digital Flexibility

Cash App’s free, customizable debit card is one of its most popular features. Issued by Sutton Bank, this Cash App Card works anywhere Visa is accepted, online or in-store. The debit card works instantly with your Cash App balance and can be personalized with colors, emojis, or custom designs.

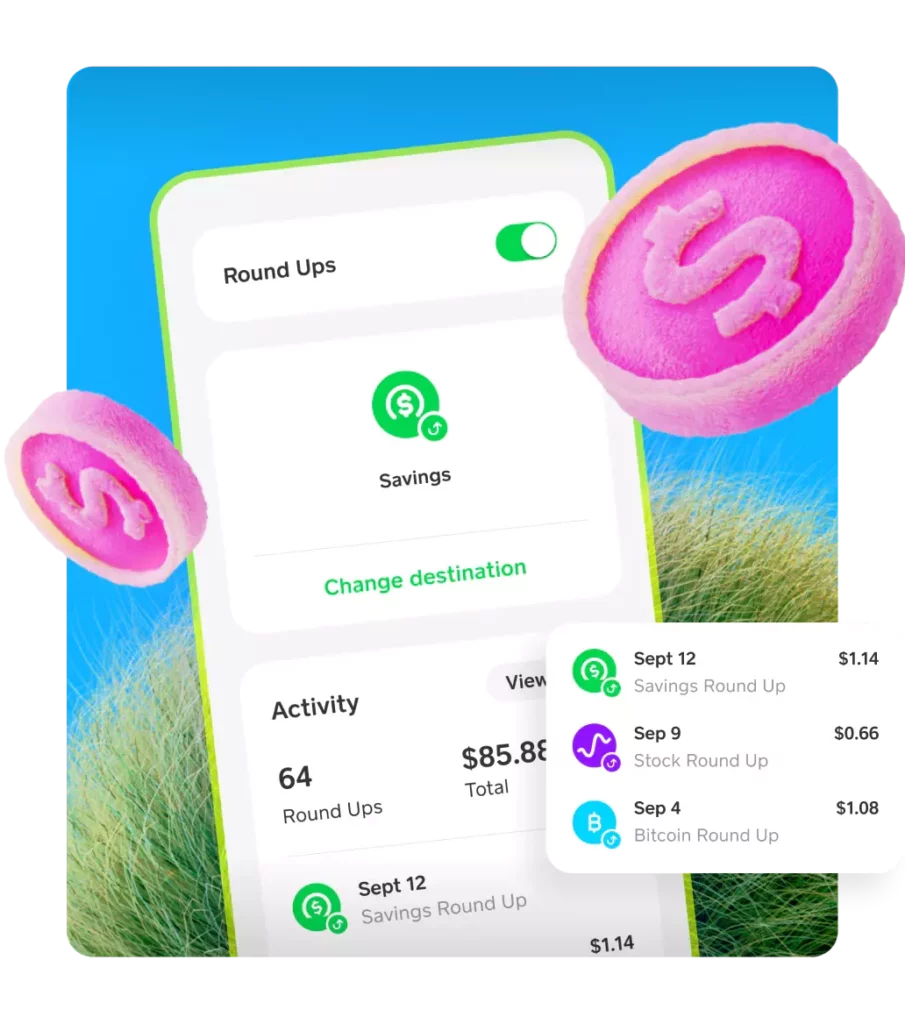

The Cash App Card (read: CASH APP CARD REVIEW) is more than just a payment method. It’s a tool for everyday spending, complete with instant savings from rotating “Boosts,” ATM access, and even integration with the app’s investing and savings features. That means when you round up purchases to the nearest dollar, the extra change can be automatically deposited into a savings or investment balance.

You can also use it for ATM withdrawals—and if you receive at least $300 via direct deposit each month, you qualify for free overdraft coverage and ATM fee reimbursement.

You’ve always technically been able to pay businesses using the app, but now you can actually get a physical Cash App card linked to your account.

You can also use the QR code feature to make payments IRL from your Cash App balance, but you might as well go for the Cash App card.

Boosts and Exclusive Discounts

Cash App’s Boosts offer exclusive discounts at top brands like DoorDash, Starbucks, or grocery stores. While only one Boost can be active at a time, users can easily swap them out depending on where they’re shopping that day.

This feature supports spending and helps users save money at checkout in real-time. Boosts are ideal for regular purchases—like your morning coffee or weekly grocery run—and often provide better value than traditional card reward programs.

Pro Tip

When you sign up for Cash App and refer your friends, you get a CASH bonus deposited to your Cash App account.

Banking (Sort Of)

Through partnerships with Sutton Bank and Lincoln Savings Bank, Cash App provides FDIC-insured banking services—though again, it is not a bank itself.

You can set up Cash App direct deposit for your paycheck, government benefits, or side gig earnings. Many users report receiving funds up to two days early compared to standard bank deposits.

Once active, direct deposit unlocks premium features:

• Eligibility for free overdraft coverage (no overdraft fees)

• Reimbursement for ATM fees

• Ability to pay bills directly from your Cash App account

• No monthly balance minimums or hidden fees

• Optional Cash App savings balance with interest on deposits

Cash App Savings

In 2025, Cash App rolled out improved saving features designed to help users save money with less effort. Instead of traditional savings accounts, Cash App uses in-app savings goals with flexible deposits. Users can create separate categories for vacation funds, emergency savings, or everyday expenses and monitor progress visually inside the app.

Cash App also offers round-up tools that allow you to automatically invest spare change or deposit it into your savings balance. When paired with direct deposit, your savings balance can even earn up to 4.5% APY—competitive with the highest interest rates among digital platforms.

Cash App Investing: For Beginners, Not Traders

Cash App Investing lets users buy stocks and ETFs with as little as $1. It’s built for beginners, with a simple interface, commission-free trades, and no account minimums.

Users can explore curated stock categories, view trending companies, and execute trades in seconds. With auto trading and the ability to purchase stocks on a schedule, it’s a smooth entry point into wealth building. Though the platform doesn’t include advanced technical tools or analyst opinions, it does cover the basics well.

Cash App Bitcoin: Buy, Send, or Receive Crypto

Cash App Bitcoin services stand out from most peer-to-peer apps. Unlike others that limit crypto to in-app use, Cash App allows buying, holding, sending, and receiving Bitcoin—both to and from external wallets.

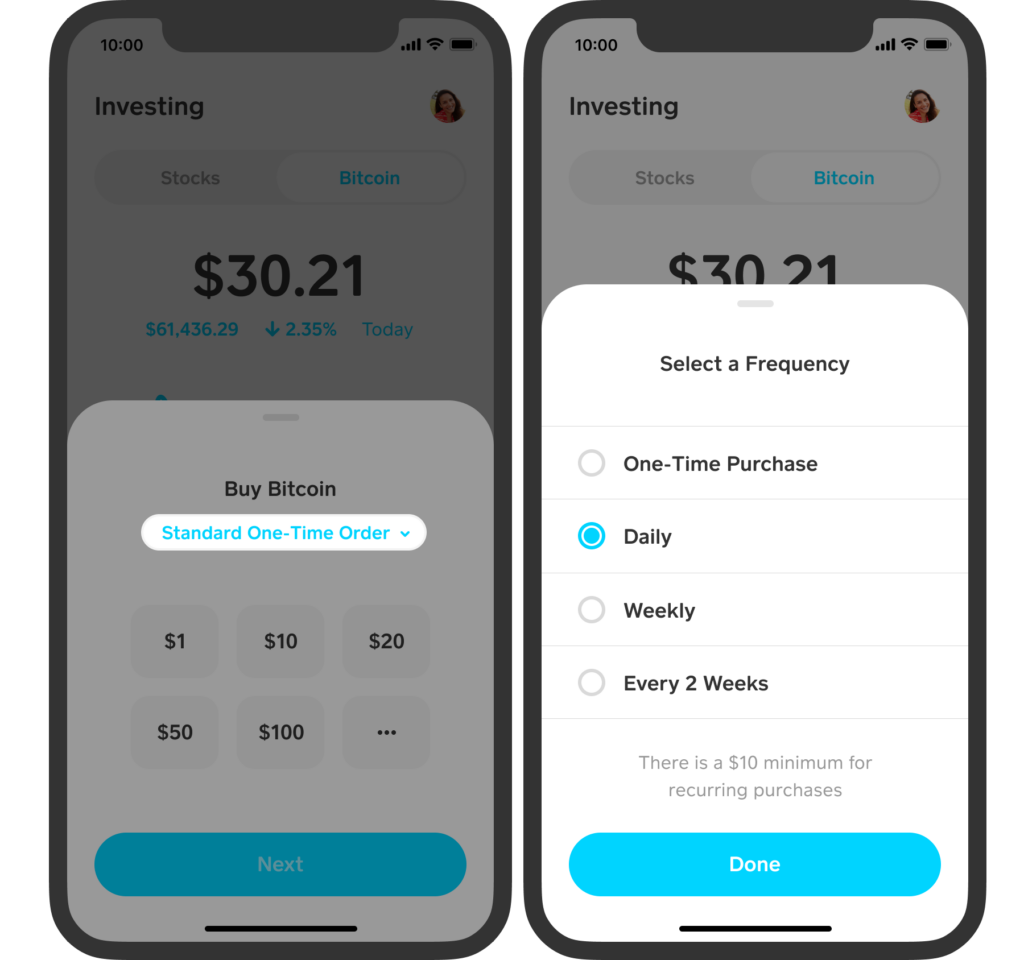

Recurring Bitcoin purchases can be scheduled daily, weekly, or biweekly. The app also supports cold storage transfers and notifies users of market trends. While Cash App doesn’t offer altcoins, its simplicity makes it one of the best platforms for beginners to start their crypto journey.

Unique Features

In addition to their Bitcoin services provided, Cash App offers Fractional Shares with their Sutton Bank banking services that means you can buy bits and pieces of really expensive stocks without having to shell out hundreds (or thousands) for the pleasure of buying into the business.

For example, if a stock’s current price is $300 but you only want to invest $100 at the moment, you can buy a third of a share of the stock.

You still gain (and lose) value in your investment as the stock price changes, but partial shares let you get started with a smaller amount of money up front (to the nearest dollar).

Cash App also offers Auto Investing, as one of their brokerage services, when the stocks hit a certain price, or even when you round up on a purchase using your Cash App debit card.

These options obviously rely on your judgement, but it’s nice to have the tools available to you to help you purchase the stocks you want, when you want them.

Be careful, though, when setting up automatic investments that are not triggered by price changes but are performed on a schedule or upon debit card purchases with your customizable debit card.

You want to make sure you’re comfortable with the stock’s price before investing your hard-earned money into it.

Cash App also offers the ability to Send Stocks to Friends (other cash app users) with your debit card!

You can send stocks as gifts (if you’re one of those weird uncles/aunts), transfer them to another account, or even buy things using stocks or ETFs instead of money.

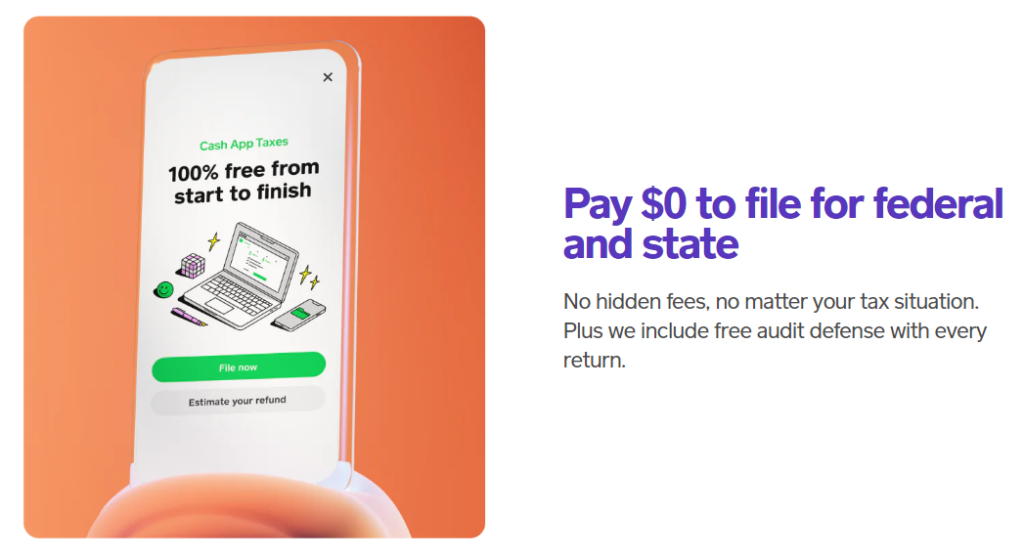

Cash App Taxes: File Free in 2025

Cash App Taxes remains one of the only truly free tax filing tools. It supports W-2 and 1099 filers, freelancers, and even those with investment income.

The platform includes free audit defense and a Max Refund Guarantee. If you choose direct deposit, your refund may even arrive up to six days earlier. Cash App also lets you scan documents like W-2s to auto-populate forms, reducing manual entry and filing time.

Pro Tip

When you sign up for Cash App and refer your friends, you get a CASH bonus deposited to your Cash App account.

Customer Support and Security

Cash App takes security seriously—and it’s a big reason why it continues to be one of the most trusted platforms in the peer-to-peer finance space. Is Cash App safe? Absolutely. Block, Inc. has invested heavily in compliance, bug fixes, and risk monitoring to keep your money safe. Users benefit from strong encryption standards and built-in account alerts and fraud monitoring services that flag suspicious activity quickly.

The app also supports biometric logins, PIN and password protection, and optional two-factor authentication. Security doesn’t end with technology either—Cash App has significantly improved customer support in recent years.

If you need assistance, you can contact Cash App support via the in-app chat or support center. Cash App customer service response times have improved significantly since 2022.

Keyword cluster: is cash app safe, contact Cash App support, cash app customer service

Pros and Cons

Cash App does a lot of things well, especially for users who want simple, mobile-first financial tools. That said, it isn’t trying to be everything for everyone—and that’s where some of its limitations show.

Pros

• Easy to send money, receive money, and manage everyday spending

• Solid entry-level tools for investing and Bitcoin trading

• No monthly minimums, hidden fees, or overdraft fees

• Legitimate, IRS-compliant tax filing via Cash App Taxes

Cons

• Not a full-service broker or savings account

• Limited crypto support (Bitcoin only)

• No joint accounts or shared sponsored accounts

While the cons may be deal-breakers for more advanced users, they’re unlikely to be an issue for Cash App’s core audience: individuals looking for ease, convenience, and quick access to key financial tools from their phone.

Final Verdict: Who Should Use Cash App in 2025?

Cash App is ideal for mobile-first users seeking simplified financial services. It works especially well for those new to investing, crypto, or digital banking, and for anyone who wants to consolidate financial tools in a single, sleek app. Users without access to a traditional bank account or those looking to avoid external transfer fees will also appreciate what Cash App offers.

However, serious traders and high-volume investors may find the tools too limited. If you need robust charting, access to altcoins, or international trading options, you’ll likely want to look elsewhere.

Personal Capital (read: PERSONAL CAPITAL REVIEW), now known as Empower, is a great compliment for Cash App. It lets you upload all your financial accounts in one place to see your net worth, set budget goals, analyze your portfolio, and more.

And if you’re looking for ways to send money internationally, Remitly (read: REMITLY REVIEW) is a great option!

FAQ

Link a bank, enable direct deposit, or receive money from another Cash App user.

Sutton Bank and Lincoln Savings Bank are its primary partners.

Yes. Use Cash App Taxes for 100% free e-filing with audit protection.

It’s a registered broker-dealer that handles your investing activity. You can read the full LLC customer agreement here.

Request it from within the app—it’s a free card you can personalize.