Acorns is one of the most well-known robo-advisors in the modern investing era, and for good reason.

Their carefully designed membership plans offer the perfect investing tools for different kinds of customers and their families.

Today, we will be doing a full review on the Acorns experience.

So keep reading this Acorns review to see what they can offer you!

What Is Acorns?

Acorns is a popular robo-advisor that has made a name for itself in the investing world through its application of a simple but powerful investing tool: round-ups.

Acorns tracks the purchases you make in your everyday life and automatically rounds up the charge to the nearest dollar.

Acorns takes the extra change from the roundup and invests it for you in a portfolio that’s suited to your financial profile and investing needs.

Did you just buy your morning cup of coffee for $5.25? Congratulations, you’ve just invested 75 cents!

You can easily manage your round-ups through the Acorns mobile app. (Read our Acorns app review.)

Acorns uses its platform to help its customers capitalize on the magical effects of compound growth.

If you can make tiny contributions to your investment accounts every day, your invested money will start earning more money.

Then, the money you originally invested plus your gains will continue to grow, creating an exponential growth effect.

Acorns makes taking advantage of the compounding effect simple and hands-off!

Investment Tip #78: Acorns Bonus Investment

Did you know? You can earn a free bonus investment just by setting up an account and making recurring investments (with a minimum of $5).

You can set up your account and recurring investments in under 3 minutes, and then your $20 BONUS will be deposited into your account!

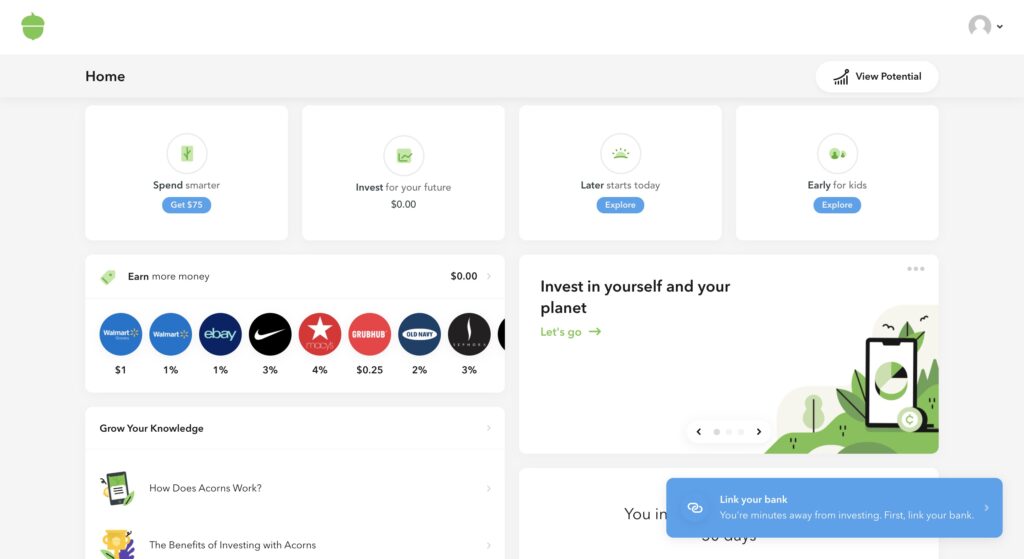

What Types of Accounts Does Acorns Support?

You can open plenty of different types of accounts through Acorns, each with their own specific purposes.

Account types range from your regular, everyday investment account to UTMA/UGMA accounts for children.

Invest Account

The Invest account is a regular brokerage account.

It has no tax advantages, no maximum contribution limits, and no penalties for withdrawals.

Unfortunately, Acorns does not offer tax-loss harvesting.

You can use your Invest account to take advantage of round-ups and bonus investments from Acorns’ partner companies.

Later Account

The Later account is a tax-advantaged individual retirement account, or IRA.

Your IRA can be a traditional IRA or a Roth IRA

IRAs are tax-advantaged, meaning that you won’t have to worry about capital gains taxes when you sell. You will be taxed at ordinary income tax rates for withdrawals from a traditional IRA.

You can take an income tax deduction for your contributions to your traditional IRA, or make contributions to your Roth IRA with after-tax dollars in order to get a tax break in retirement.

Acorns Silver subscribers now qualify for 1% matching for IRA contributions, and Acorns Gold subscribers receive 3% matching contributions. Essentially, it’s free money that Acorns gives you with every contribution!

IRAs do have contribution limits and early withdrawal penalties.

Banking Account

The Banking account is a checking account.

The Acorns checking account comes with a free, heavy metal debit card for Bronze subscribers and the Mighty Oak card for Silver and Gold subscribers. With either card, you’ll have access to over 55,000 ATMs around the world.

Best of all, you can earn up to 2.57% APY on your checking account and up to 4.05% APY on your emergency savings account.

You can connect your Banking account to your Invest and Later accounts, making the transferring of money from the checking account to the brokerage seamless.

Invest Early Account

The Acorns Invest Early account is an UTMA/UGMA account.

These accounts are custodial accounts for children, so you can start investing for them while they’re young and then transfer the accounts to their name when they come of age.

UTMA/UGMA accounts have some small tax advantages, with the first $19,000 you contribute annually being tax-free. Amounts over that limit are subject to taxation.

Customer Service:

Phone at (855)739-2859 M-F 5:00:7:00 PST

Email at support@acorns.com

ACORNS SUMMARY

What You Get:

- Brokerage, Retirement, and Custodial Accounts

- Checking Account with Metal Debit Card

- Earn Rewards for Shopping Online

The Acorns Appeal:

- Round-Ups Let You Build Your Portfolio Through Everyday Transactions

- Acorns Earn Can Help You Find a New Job

Acorns Pricing:

- Acorns Bronze Costs $3 per Month

- Acorns Silver Costs $6 per Month

- Acorns Gold Costs $12 per Month

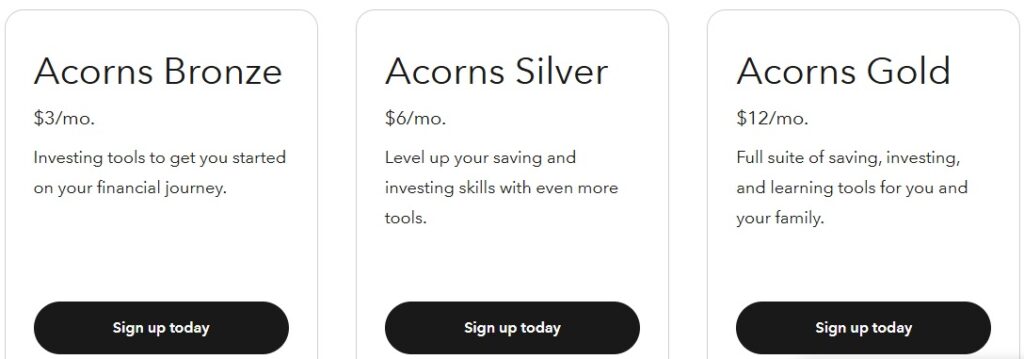

What Membership Plans Does Acorns Offer?

Acorns offers three different membership plans based on your investing needs.

Each plan gives you access to different Acorns features that can help you invest through a regular, taxable brokerage account, start saving for retirement with a tax-advantaged retirement account, or even start investing for your children.

Acorns Bronze

The Bronze plan gives you access to Invest, Later, and Banking accounts.

When taking advantage of the Later feature, you will have a tax-advantaged retirement account.

With the Banking feature, you will get a bank account along with a heavy metal debit card that can earn you bonus investments when used at partner businesses.

The Bronze plan is ideal for investors who want access to a retirement account such as a Roth IRA and who want to bank with Acorns.

Acorns Silver

Acorns Silver is a relatively new option and serves as an upgraded plan for individuals who want access to more features than the Bronze plan offers.

The Silver Plan gives you access to all the features that come with the Bronze Plan, plus a Mighty Oak debit card if you open a bank account with Acorns, 1% IRA matching funds, access to the Acorns Emergency Fund, 25% matching on bonus investments, plus access to live Q&As with investing experts.

Acorns Gold

The Gold plan gives you access to Invest, Later, Banking, and Early.

The Early feature allows you to open UTMA/UGMA accounts for children, as well as set up recurring investments for those accounts.

In addition to everything that comes with the Silver Plan, you’ll get 3% IRA matching, 1% matching on kids’ investment accounts, 50% matching for bonus investments, and the Acorns Early app and debit cards for your kids.

Acorns Gold also comes with free financial education for families, so you can know what you’re doing when it comes to your children’s financial future.

The Gold plan is ideal for investors who have minors inside or outside their families who they want to start investing for.

Investment Tip #78: Acorns Bonus Investment

Did you know? You can earn a free bonus investment just by setting up an account and making recurring investments (with a minimum of $5).

You can set up your account and recurring investments in under 3 minutes, and then your $20 BONUS will be deposited into your account!

Does Acorns Have ESG Options?

Yes! Acorns offers a Sustainable portfolio filled with ETFs that are specifically made for ESG (environmental, social, and governance) investing.

This is a type of impact investing that allows you to invest in companies that are working to reduce their carbon footprint, giving resources towards social justice causes, and holding themselves to the highest governance and accounting standards.

According to Acorns, their Sustainable Portfolio is made to perform on par with the Core portfolios, and some of the leading ESG ETFs in the market have even outperformed the traditional indices.

If you already have a portfolio with Acorns, switching over to the Sustainable Portfolio is free; however, in order to switch from Core to Sustainable, Acorns will sell off the ETFs in your preexisting portfolio, which could create a taxable event.

You can switch by tapping Portfolio in the Acorns app, and then tapping Theme to choose the Sustainable portfolio.

Acorns Earn

Acorns also has a rewards program called Earn.

Earn helps you earn bonus investments just by shopping online.

The first step to using Earn is to download the Acorns Earn extension for Google Chrome or Safari.

Then, you can go ahead and browse online and make purchases the same way you normally would.

When you come across a purchase that’s eligible for a bonus investment, the Acorns icon will light up and let you know. Some of the eligible retailers include Walmart, Apple, Staples, and Hello Fresh.

Then, you simply log in and take advantage of the rewards. Easy!

Acorns Earn can also help you find a new job. The platform has a huge database of job listings that can help you change careers, find a better-paying job, or start a part-time side hustle to supplement your income.

Basically, Acorns Earn is an entire part of the platform dedicated to making you more money!

Acorns Learn

Acorns has an entire section on their platform dedicated to financial education.

The “Learn” section is complete with videos and articles to help you understand some personal finance concepts and get the most out of the Acorns platform.

Some of the learning topics you’ll find there include Investing, Retiring, Saving, and Planning.

The articles have a summary at the top, like a TL;DR section to help you take a quick glance at the topic without reading the entire article.

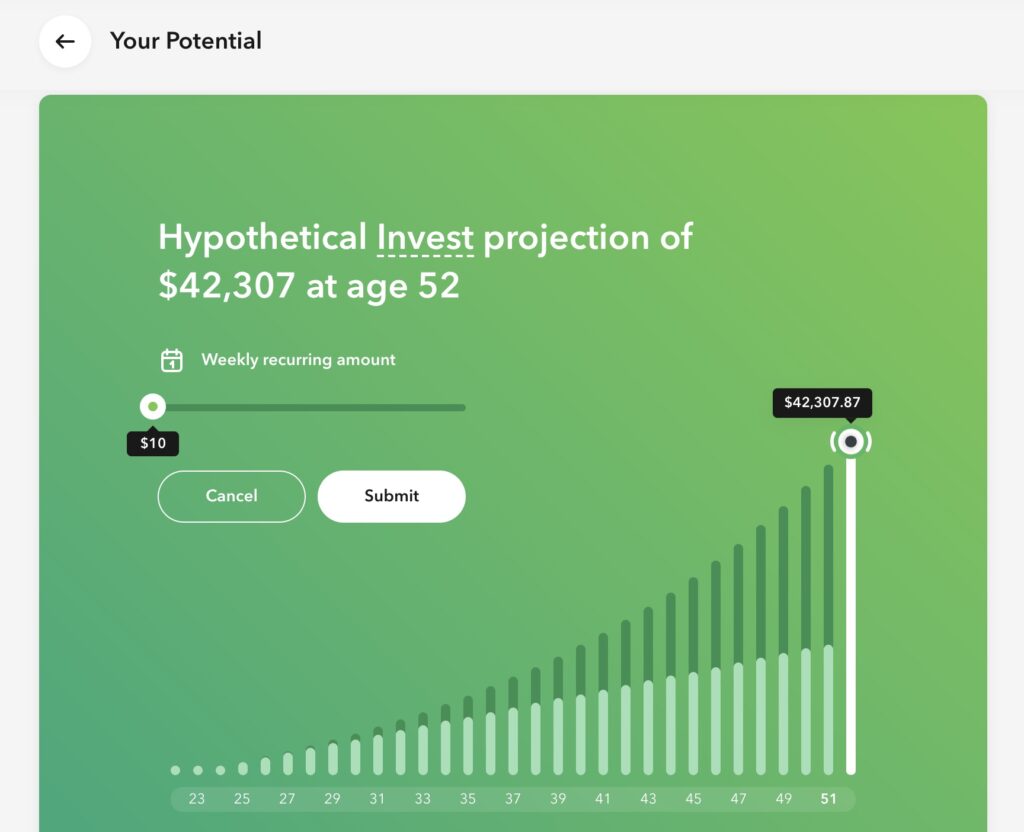

There is also a Compound Interest Calculator to help you figure out how much money you’ll have in the future.

You can configure the calculator with a lump-sum deposit, recurring payments, an investing horizon, and an interest rate.

How Does Acorns Make Money?

Acorns makes money by charging fixed, monthly fees for each of its three investing plans. Here’s a reminder of the Acorns fees for each plan:

- Bronze costs $3 per month and gives you access to Invest, Later, and Banking.

- Silver costs $6 per month and gives you access to Invest, Later, Banking, and matching for IRA contributions and bonus investments.

- Gold costs $12 per month and gives you access to Invest, Later, Banking, and Early, plus the highest matching for IRA contributions and bonus investments and the Acorns Early app with kids’ debit cards.

Don’t forget that you’ll also have to pay (relatively small) management fees for each individual ETF you’re invested in.

These fees go to the fund managers, not Acorns.

An ETF’s management expense ratio isn’t a direct expense you pay out of your investment account; instead, the value of your ETF is simply reduced automatically by the amount of its expense ratio.

Investment Tip #78: Acorns Bonus Investment

Did you know? You can earn a free bonus investment just by setting up an account and making recurring investments (with a minimum of $5).

You can set up your account and recurring investments in under 3 minutes, and then your $20 BONUS will be deposited into your account!

Is Acorns Worth It?

As we discussed earlier, Acorns charges a monthly fee rather than a percentage of your investments.

So, are these flat fees a good thing or a bad thing?

That depends on how much money you have in your investment account.

Most other robo-advisors charge you a management fee that is based on your AUM, or assets under management.

With any other major robo-advisor, this fee will be somewhere around 0.25% per year.

So, if you had $100 in your account, your management fee would be 25 cents per year…

…if you had $1,000 in your account, your management fee would be $2.50 per year…

…if you had $10,000 in your account, your management fee would be $25 per year…

…and so on.

Essentially, the dollar amount of your management fee increases with the amount of money you have in your account whenever the fee is a percentage.

With Acorns, the flat account fees have the opposite effect.

Let’s say you sign up for the Bronze plan, which is Acorns’ most popular plan.

You know that your monthly fee will be $3, which might not sound like a lot.

But if you have a relatively small portfolio, this monthly fee could actually come out to be more than you would pay at a different robo-advisor with a fee that’s a percentage of AUM.

For example, if you have $100 in your Acorns account, your $3 monthly fee will be $36 per year, which comes out to to a whopping 36% of AUM…

… that’s 144 times the 0.25% average for other robo-advisors.

If you have $1,000 in your Acorns account, the fee would be 0.36% of AUM, still way higher than 0.25%.

In order to make Acorns Bronze “worth it,” you would have to have $14,400 in your account.

This would put your annual management fee at exactly 0.25%, which is on par with most other robo-advisors.

If you have more than $14,400 in your Acorns account, then the flat fee will be less expensive than a 0.25% management fee!

If you have the Acorns Silver plan, you would need to have at least $28,800 in your account to get under a 0.25% management fee.

As an Acorns Gold subscriber, you’d need a portfolio worth $57,600 to get under a 0.25% management fee.

Those numbers might be daunting, but they’re not the only consideration.

Acorns makes investing extremely easy, and for some people, access to round-up investments and Acorns’ other features may be worth the fee as they build their portfolios.

The other thing to keep in mind is that Acorns’ matching fees and other features can help you build your portfolio quickly. While the dollar amounts might be small at first, rounding up your payments means you’ll be investing every time you make a purchase.

Final Thoughts

Acorns has created quite the investing experience with its robo-advisor platform, and it’s not planning on stopping.

You can invest with several types of investment accounts, bank with a checking account, and more.

Both its older and newer products never cease to impress, and we believe that any type of investor can find a home with Acorns.

Just be sure to take into account that while the platform’s monthly fees may seem low, you need to have a certain amount of money in your portfolio to ensure that your management fee isn’t drastically higher than those of many other robo-advisors.

We hope this Acorns review 2025 has shown you everything you need to know about the platform.

If you want to compare Acorns to a popular competitor Stash in 2025, check out: ACORNS VS STASH: WHICH INVESTMENT PLATFORM IS BETTER?

Now, to see how Acorns stacks up against another big player in the investing game, read our head-to-head article, Robinhood vs Acorns!

Or, if you’re looking for more ways to automate your financial life, check out our Composer review!