Health Savings Accounts (HSAs) continue to be one of the most tax-advantaged tools for individuals and families trying to manage rising healthcare costs while investing for the future. Lively has quickly become a top choice in this space, thanks to its zero-fee model, user-friendly tech, and robust investment options. Read our full Lively review to see why it’s earned a top spot among today’s best HSAs.

But is it the best HSA provider for 2025? In this Lively HSA review, we’ll break down how the platform works, what it offers, where it shines, and where it may fall short compared to competitors like Fidelity, HealthEquity, and HSA Bank.

What Is Lively?

Lively is a San Francisco-based fintech company founded in 2016 to modernize and simplify the health savings account experience. It offers individuals, employers, and the self-employed a fee-free HSA with an intuitive platform and strong customer support. Lively partners with TD Ameritrade and Devenir to provide both self-directed and managed investment options.

For 2025, Lively remains one of the few HSA providers offering a zero annual fee, FDIC-insured savings account, and low-cost investing—all accessible from your phone or laptop.

Tax Benefits of an HSA

A major appeal of using an HSA is its triple-tax advantage. Contributions are made with pre-tax dollars, lowering your taxable income in the current year. Any growth within the account—whether from interest or investments—is tax-free. And as long as the money is used for qualified medical expenses, withdrawals are also completely tax-free. This makes HSAs a powerful tool for both short-term budgeting and long-term financial planning.

How Does a Lively HSA Work?

A Lively HSA functions just like any other health savings account. It’s designed for individuals enrolled in a high-deductible health plan (HDHP) to save for qualified medical expenses using pre-tax dollars.

With Lively, you can contribute up to the IRS HSA limits for 2025 ($4,150 for individuals, $8,300 for families, plus $1,000 catch-up if 55+), enjoy tax-free growth, and withdraw funds tax-free for qualified expenses.

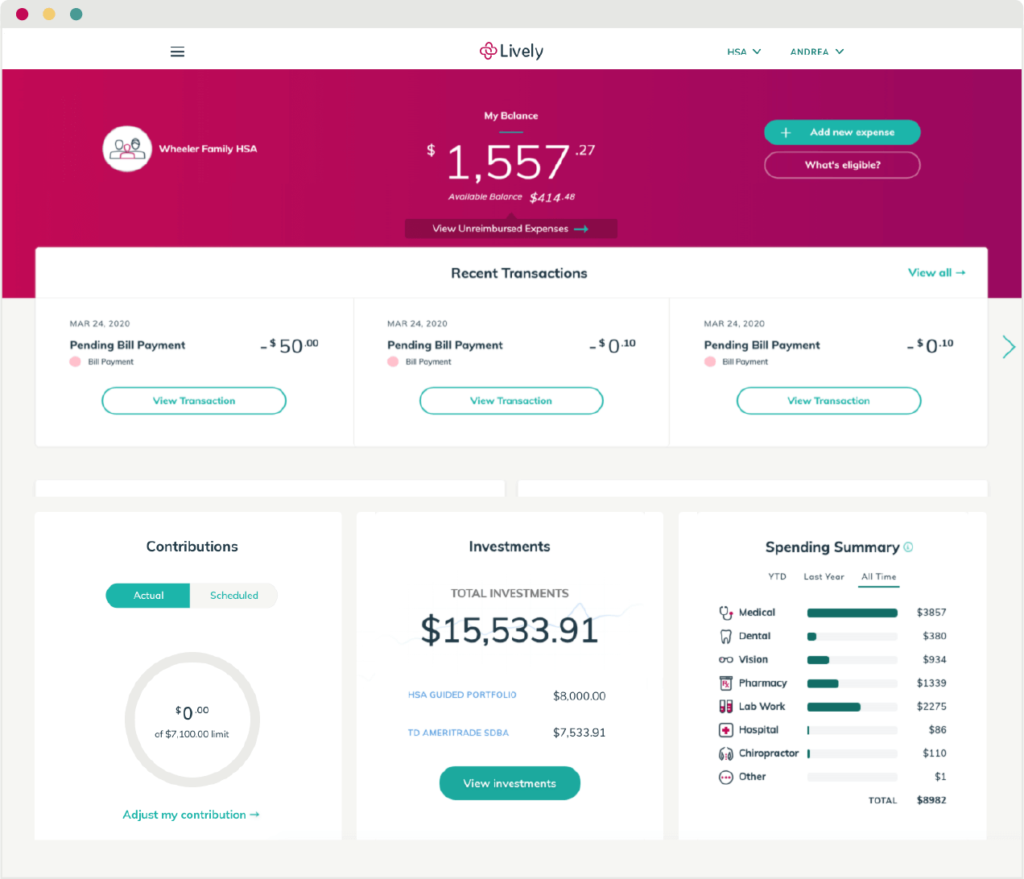

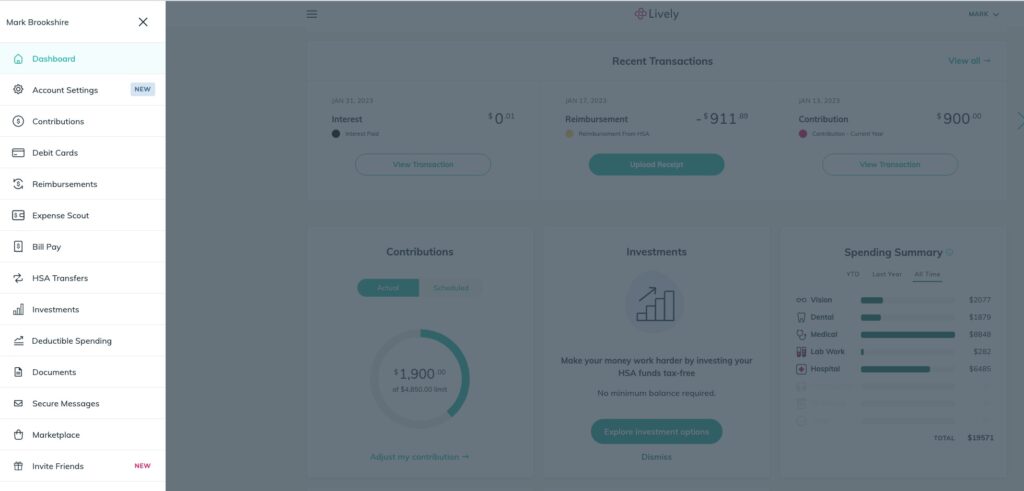

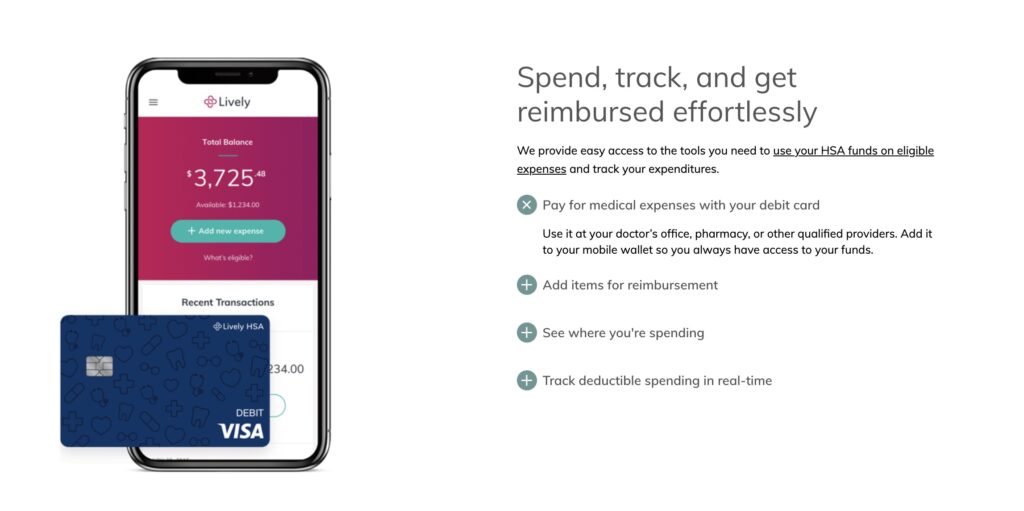

The platform makes it easy to manage contributions, spending, and investments. You can spend HSA funds using a Lively-issued debit card, track receipts and upload documentation for reimbursement, invest your HSA balance in mutual funds, ETFs, and individual stocks, and set up recurring contributions from a bank account or employer. Everything is managed through a clean, secure online dashboard or mobile app.

Pro Tip:

Ready to make your HSA work harder? Open a Lively HSA today and start investing with zero fees.

Investment Options and Account Structure

Lively gives users the flexibility to either save conservatively or invest for long-term growth. Whether you want to keep your HSA dollars in a stable, interest-bearing account or put them to work in the market, the platform makes it easy to manage both paths.

HSA Savings Account

Every Lively user starts with a traditional, FDIC-insured HSA savings account, which earns interest and has no minimum balance or monthly fees. It’s ideal for short-term medical expenses or those who prefer to avoid market risk.

HSA Investment Account

Once your HSA reaches a transfer threshold (typically $1 or more), you can move funds into a connected investment account through TD Ameritrade or Devenir. The self-directed brokerage account via TD Ameritrade provides access to commission-free ETFs, individual stocks, and other investments. Alternatively, the guided portfolio through Devenir offers automatic rebalancing based on your risk tolerance and goals.

Lively’s investment options support dollar cost averaging and long-term growth. While Lively itself does not charge investment management fees, standard fund expense ratios and transaction costs may apply.

Pro Tip:

Need to transfer your current HSA? Lively makes it easy with rollover support and no transfer fees.

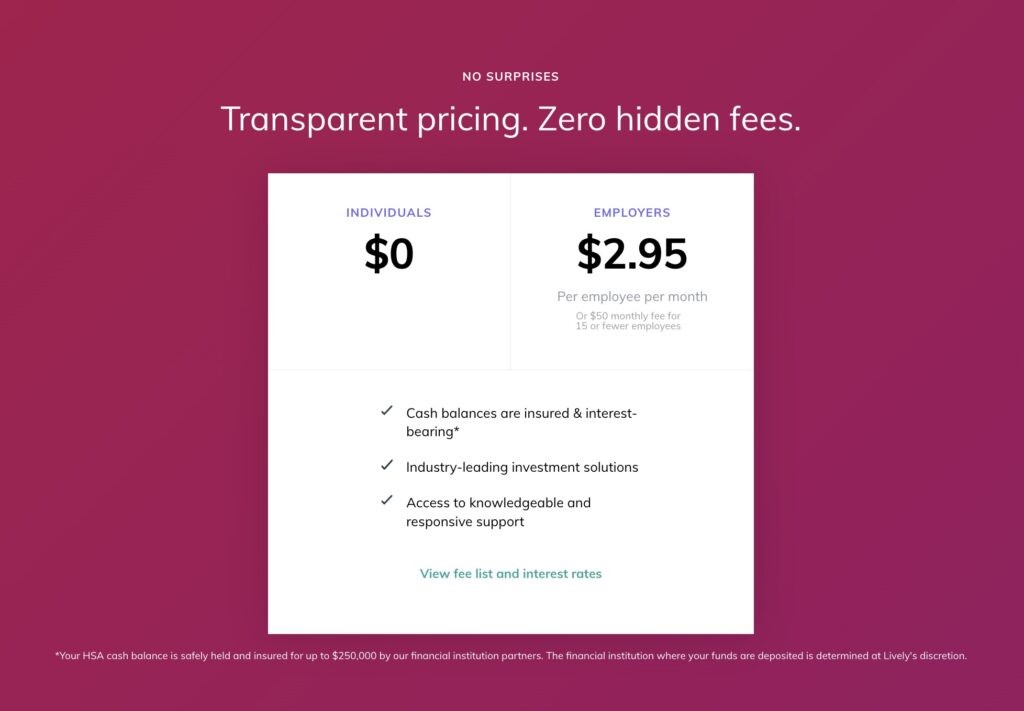

Fees and Costs

One of Lively’s biggest differentiators is its transparent fee-free model. There are no monthly maintenance fees, no minimum balance requirement, no opening or closing fees, and no hidden charges for using the debit card or submitting reimbursement requests.

The only potential costs are tied to investments. If you choose to invest your HSA funds, you may encounter transaction fees or expense ratios depending on the investments selected. Otherwise, users who keep their HSA funds in the default savings account can use Lively entirely fee-free.

Who Should Use Lively?

Whether you’re just starting to explore health savings accounts or looking to upgrade from a provider that charges unnecessary fees, Lively offers a streamlined solution. Before diving into who benefits most, let’s look at the types of users who tend to get the most value from its platform.

Ideal Users

Lively is a great fit for individuals and families who want to maximize their health savings account without losing money to fees. It’s also an excellent choice for those interested in growing their HSA investments over time through ETFs, mutual funds, or individual stocks.

Freelancers, gig workers, and the self-employed will appreciate the ease of setting up and managing a personal HSA account without going through an employer. Employers looking to offer a competitive and simple HSA option will also find value in Lively’s employer-facing tools.

Pro Tip:

Feel like an ideal Lively user? Start your tax advantaged account today for 2025!

Considerations

While Lively offers robust features, it may not be ideal for everyone. For a more traditional banking experience or in-person services, users might consider a provider like HealthEquity. If you’re looking for in-person banking services or want an integrated checking account tied to your HSA, you might prefer a more traditional provider like HealthEquity. Additionally, investment tools, while flexible, do require creating a separate login with TD Ameritrade or Devenir.

Pros and Cons of Lively

Like any financial tool, Lively has its advantages and a few potential drawbacks depending on your preferences and goals. Here’s a breakdown to help you decide whether it’s the right HSA provider for your situation.

Pros

Lively offers a truly fee-free HSA account for both spending and saving. Its broad range of investment options includes individual stocks, ETFs, and mutual funds, giving users control over how their HSA dollars grow (read: BEST HSA ACCOUNTS). By partnering with TD Ameritrade and Devenir, Lively ensures a flexible investment experience. The platform is anchored by an FDIC-insured cash savings account and features an intuitive dashboard accessible via both desktop and mobile. Customer support is consistently rated well, and the company maintains a transparent, trustworthy reputation. For broader financial management, it can pair well with tools like Personal Capital (read: PERSONAL CAPITAL REVIEW).

Cons

Investments through Lively require a separate account with TD Ameritrade or Devenir, which may be an extra step for some users. There are no physical branches or in-person support options. Lastly, users unfamiliar with brokerage accounts may find the investment setup slightly overwhelming at first.

HSA Portability

One of the lesser-discussed strengths of Lively is how easy it makes it to transfer or roll over your current HSA. If you’re switching from another provider, Lively supports both trustee-to-trustee transfers and rollovers, ensuring your funds maintain their tax-advantaged status. There are no transfer fees, and the dashboard guides users step-by-step through the process, making it accessible for even first-time HSA owners.

Employer Integration

Lively isn’t just built for individuals—it’s also designed with employers in mind. The platform offers modern tools that make it easy for businesses of all sizes to set up and manage HSA contributions for their employees. From automated payroll deduction syncing to centralized reporting and employee onboarding resources, Lively helps streamline what is often a complex process. It’s an ideal choice for small to mid-size companies seeking a low-friction way to offer competitive health benefits.

HSA Mobile App Experience

Lively’s mobile app is designed to match the expectations of users accustomed to modern financial tools. It allows you to view your HSA balance, track past transactions, upload receipts for reimbursement, and initiate investment transfers—all from your smartphone. With biometric login, responsive customer chat support, and a real-time dashboard, the app enables users to stay connected to their health savings account whether they’re at the doctor’s office or planning for tax season. For individuals and families who want on-the-go access to their HSA funds and investments, the Lively mobile app is an invaluable companion.

Lively vs. Traditional Banks

Traditional banks typically treat HSAs as an add-on to their core services, with limited tools and clunky interfaces. Lively flips that model by focusing solely on HSAs—and it shows. Unlike bank-based HSA providers that often impose minimum balance requirements or account maintenance fees, Lively prioritizes simplicity and cost efficiency. Its all-digital experience, zero-fee structure, and built-in investment access provide significant advantages for users who want more control and transparency.

Health Insurance Compatibility

To open a Lively HSA, you must be enrolled in a high-deductible health plan (HDHP) that qualifies under current IRS guidelines. Lively works seamlessly with most health insurance providers, including those offered through private plans, employer-sponsored benefits, or health insurance marketplaces. Its enrollment process allows users to link their coverage details and manage documents directly through the dashboard, making it easy to maintain compliance and eligibility.

How Lively Supports Financial Planning

Beyond healthcare spending, a well-managed HSA can support your broader financial goals. Lively helps users plan for expected and unexpected medical expenses while reducing taxable income. By offering tax-deferred investing and tax-free withdrawals for qualified expenses, Lively plays a vital role in retirement planning, especially for those anticipating higher healthcare costs later in life. Users can use Lively in combination with personal finance tools to track their net worth, optimize savings, and ensure they’re leveraging every available tax advantage.

How Does Lively Compare to Other HSA Providers?

Compared to banks and other HSA fintech providers, Lively distinguishes itself with its fee-free model and streamlined digital experience. You can find it listed in our roundup of the best HSA accounts. While Fidelity and HSA Bank are strong alternatives, Lively excels at combining simplicity with customization. Its investment options are competitive, and the user interface is one of the cleanest in the space.

Overall Value

Lively offers a compelling blend of cost transparency, flexibility, and modern user experience that puts it at the top of the HSA space in 2025. Whether you’re looking to save on medical costs today or invest for the long run, its fee-free structure and powerful integration options make it an ideal fit for a wide range of users. It’s not only one of the most affordable options on the market, but one of the most functional—perfect for hands-on savers and hands-off investors alike.

FAQ

Yes. All uninvested HSA funds are held in an FDIC-insured account.

Yes. You can transfer to a brokerage account or a guided portfolio and invest in commission-free ETFs, individual stocks, and more.

Lively charges no account fees. The only fees you may encounter are from investment transactions or fund expense ratios.

You can use your HSA for any qualified medical expenses, including prescriptions, dental work, vision care, and even some over-the-counter items.

Yes. You can transfer funds from another HSA without losing tax advantages. Lively offers full rollover support.