You might expect that with all of the various stock brokerage platforms available, both mobile and online, that they have a lot in common. They all make stock trades, so what is the real difference, if any? Well there are a lot of small differences that you should know about before you open an account. Here at WallStreetSurvivor we specialize in reviewing financial apps to help make you become a smarter investor.

It’s for that reason that we’re comparing Moomoo vs Robinhood. Both are stock trading platforms with web and mobile options. Both strive to make the user experience intuitive and approachable. Both now have over 20,000,000 users. And both offer commission-free trading.

Whether you’re just getting ready to make your very first investment or you already have some experience with trading, you might be considering Robinhood or Moomoo and wondering which one to try.

Understanding the differences between the two platforms is essential before you pick one over the other. In this guide, we’ll compare fees, features, usability, and tools to help you decide which platform best aligns with your investing goals.

Overview of Robinhood vs Moomoo

We always start with an overview because it’s the best way to understand any trading platform and what it offers you as an investor.

Robinhood

Robinhood is a mobile-first trading platform that was founded in 2013 by Baiju Bhatt and Vladimir Tenev. The company is headquartered in Menlo Park, California, and its mission is to make investing accessible and fun. Their target audience is mostly younger people, including Millennials and Gens Y and Z.

Robinhood was the first electronic trading platform to offer commission-free trading, and that’s something that has helped them attract 10 million active monthly users. The company is a member of the SIPC and uninvested deposits are insured by the FDIC.

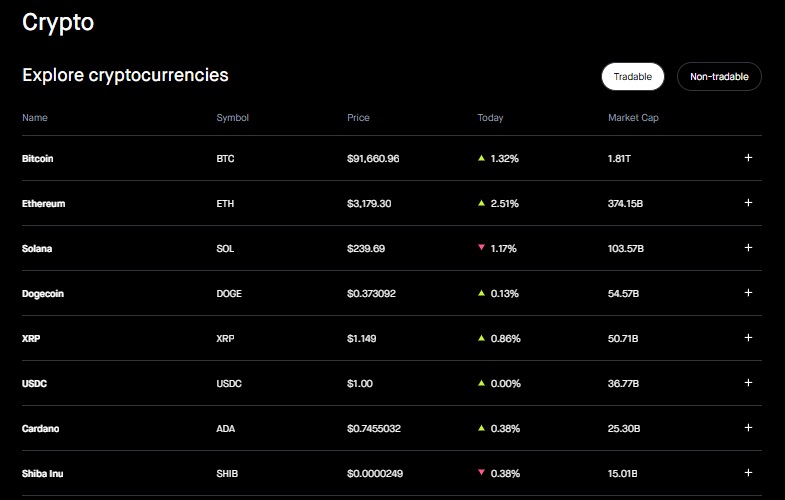

The Robinhood mobile app launched in 2015. After announcing their intention to add cryptocurrency trading as an option, they built a waiting list of two million people. Crypto trading was launched in 2018. Robinhood offers margin trading, a crypto wallet, and 20 crypto coins for trading, including Bitcoin, Dogecoin, Ethereum, and Litecoin. (Read: Coinbase vs Robinhood)

Some of Robinhood’s key features include a user-friendly and intuitive interface, option and crypto trading, and the option to buy fractional shares.

Moomoo

Like Robinhood, Moomoo is a fin-tech trading platform, but it’s focused on providing intermediate investors with the tools they need to make informed investment decisions.

The company was founded in Silicon Valley in 2018 with the aim of providing investors with stronger support and more research and informational resources than other trading platforms. They obtained an SEC license to operate in all 50 states.

Some of the things that set Moomoo apart for advanced traders are their advanced charting tools and Level 2 data, low fees, paper trading, and access to the Hong Kong stock market.

Overall, Moomoo is a good choice for beginner investors who don’t mind learning as they go, and for intermediate investors who want an accessible mobile trading experience with more features than the other apps that are available.

If you want to know more about the safety and legitimacy of Moomoo and its security features, check out our new article: Is Moomoo Safe?

Pro Tip:

U.S. Residents: When you sign up for moomoo, you can earn up to 60 FREE STOCKS after qualifying deposits! Or, with Robinhood you can get one free stock and then refer friends to earn up to $1,500 per year in FREE STOCK!

Canada Residents: Robinhood is not available. For moomoo, you can get up to $200 in cash when you fund your account if youvisit this moomoo Canada promo page.

Moomoo vs Robinhood: Features Comparison

There are important comparisons to make before you sign up for either Moomoo or Robinhood. Here’s our take on Robinhood vs Moomoo features and prices.

Fees and Pricing Structure

The fee structures for Moomoo and Robinhood are similar but not identical. This table illustrates the similarities and differences.

| Moomoo | Robinhood | |

| Trading commission | $0 | $0 |

| Hong Kong trading commission | 0.03% | N/A |

| Trading activity fee (Equity sells) | $0.000166/share; minimum $0.01 per trade, maximum $8.30 per trade | $0.000166/share; minimum $0.01 per trade, maximum $8.30 per trade |

| Trading activity fee (Options sells) | $0.00279/share; minimum $0.01 per trade, maximum $8.30 per trade | $0.00279/share; minimum $0.01 per trade, maximum $8.30 per trade |

| Options fee | $0.50 per contract | $0.50 per contract; $0.35 for Robinhood Gold users |

| Options regulatory fee | $0.013 per contract | Varies by exchange |

| SEC fee (sells only) | $.0000278 * transaction amount, minimum $0.01 | $.0000278 * transaction amount, minimum $0.01 |

| Outgoing wire transfer | $20 domestic; $25 international | $25 |

| Margin rate | 4.8% for US stocks; 6.8% for Hong Kong stocks | 5.75% for balances under $50k; view full table |

| Stock transfer | $75 | $75 |

Moomoo’s fees are more involved than Robinhood’s because they offer more trading options.

All fees are disclosed at the time of the transaction. If you decide to upgrade to Robinhood Gold, the current cost is $5 per month or $50 per year, although as of December 2024, Robinhood has indicated that a price increase may be coming.

Usability and Interface

Usability and an app’s interface are closely related and should play a role in any trader’s decision about which platform to use.

Robinhood has a mobile app and web interface that are designed to be extremely easy to use, even for beginners who have never invested before. The menu is minimalist, and even new investors can figure it out, choose an asset to buy, and make their first trade in just a minute or two.

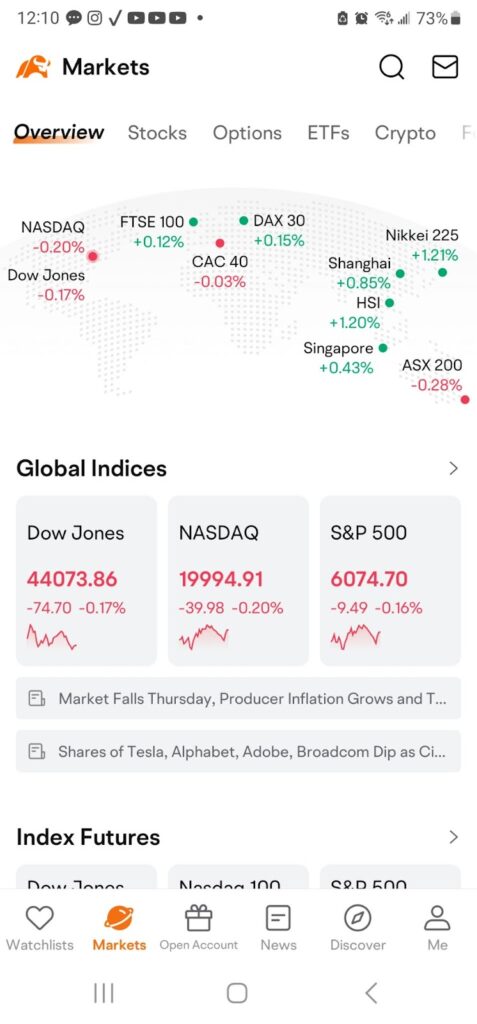

The interface for Moomoo is a little more complex, but not so difficult to comprehend that beginners can’t use it. They offer more advanced charting options and some different assets than Robinhood for advanced traders, including access to Hong Kong markets. We’d say that the interface is still intuitive and approachable, but it may take a little longer to get comfortable with it compared to Robinhood.

Trading Tools and Analytics

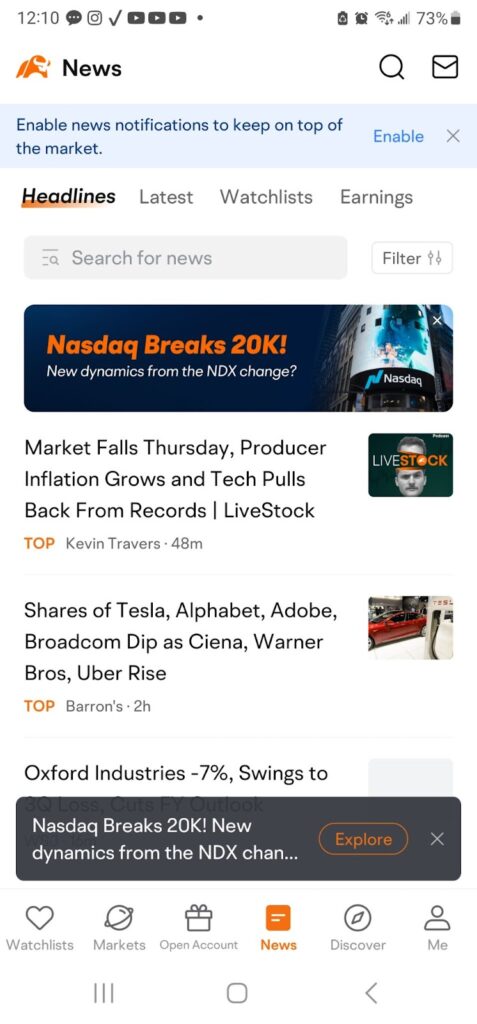

Robinhood offers a minimal selection of options trading, trading tools, and analytics. You can view some of their preset watchlists and of course, view your portfolio. You’ll also have access to real-time market prices. Both the app and the web portal offer access to their learning center, which features a selection of relevant articles from trusted resources such as Barron’s and MarketWatch, as well as some videos and webinars to help you learn about investing.

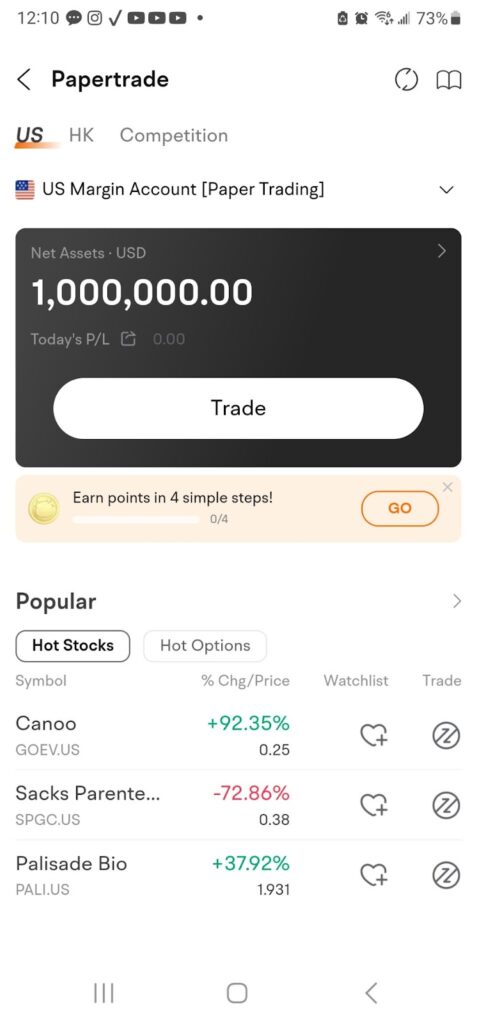

Moomoo has a lot more than Robinhood when it comes to analytical tools. and options trading. Some examples include Level 2 data, including tools to evaluate market sentiment, liquidity, and more. They offer multi-monitor set-ups, technical indicators, and a set of 28 chart-drawing tools, plus custom tools. You’ll also find paper trading to help you learn about investing.

Investment Options

All investing involves risk and there are some key differences between Robinhood and Moomoo when it comes to investment options.

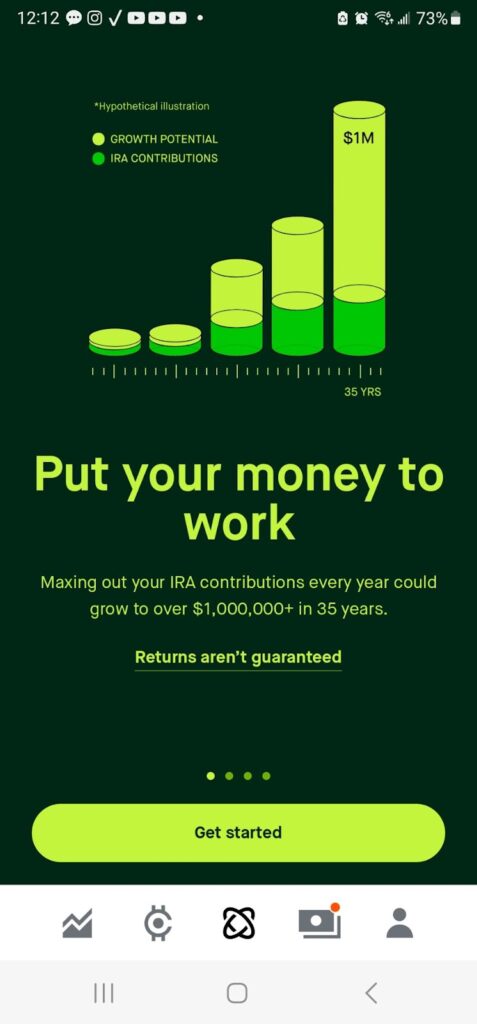

Robinhood offers trading of US stocks, ETFs, options, ADRs, and 20 cryptocurrencies. They don’t offer bonds, mutual funds, futures, commodities, or Forex. In terms of trade types, you can carry out market orders, limit orders, stop orders, and stop-limit orders. Robinhood also offers users the option to open an IRA. With a free account, you’ll earn 1% matching contributions, and that increases to 3% if you subscribe to Robinhood Gold.

Moomoo offers trading of United State and Hong Kong stocks and ETFs, REITs, and IPO subscriptions. They don’t offer cryptocurrency trading, futures, commodities or Forex. Available trade types include market orders, limit orders, stop-loss orders, trailing stop orders, and limit-if-touched orders.

Pro Tip:

When you sign up for moomoo, you can earn up to 60 FREE STOCKS after qualifying deposits! Plus, with Robinhood you can refer friends to earn up to $1500 per year in FREE STOCK!

When to Go with Moomoo

If you’re an active or experienced trader, Moomoo has more to offer than Robinhood. Choosing Moomoo gives you access to:

- Advanced Features: Real-time market data, Level II quotes, technical charting, and other advanced tools.

- In-Depth Research: Detailed financial reports, earnings estimates, and market news and analysis.

- Global Trading: Access to US and international markets, including Hong Kong

- Active Trading: The data and flexibility for those who want to take control of their portfolios.

Beginners may find Moomoo to be a bit overwhelming, but it’s an excellent choice for people with more experience.

When to Go with Robinhood

Robinhood was specifically designed to be an entry-level and intuitive trading platform that’s ideal for beginners. Here’s what you’ll find if you choose Robinhood as your investment platform.

- Mobile-First Trading. If you’re someone who wants to be able to trade from anywhere and at any time, Robinhood’s streamlined mobile app can help you do it.

- Simplicity. Robinhood is known for its user-friendly interface and intuitive trading.

- Incentives to Join. New Robinhood users can get a free stock just for signing up, and you may also get a free stock if you refer a friend who signs up.

- Long-Term Investing. Robinhood is ideal for people who want to use a buy-and-hold strategy for long-term investing.

We would say that if you’re a beginner or a casual investor, or someone who just wants a tool that will help you trade stocks and other assets quickly, then Robinhood is the right choice for you. It’s also a good choice if you want to dip into cryptocurrency investing. We particularly like the option to buy fractional shares.

We should note that Moomoo doesn’t offer cryptocurrency trading, and neither platform offers bonds or mutual funds, both of which are important in portfolio balancing and diversification.

Who Should Use Robinhood vs Moomoo?

You’re probably wondering which investing platform is best for you: Moomoo or Robinhood? Here’s our breakdown.

Robinhood was specifically designed to be an entry-level and intuitive trading platform that’s ideal for beginners. The company prioritized creating a user-friendly interface with minimal menu options and features. They were the first trading platform to offer $0 commission trades and their fees are low compared to many other platforms, including extended trading hours.

We would say that if you’re a beginner or a casual investor, or someone who just wants a tool that will help you trade stocks and other assets quickly, then Robinhood is the right choice for you. It’s also a good choice if you want to dip into cryptocurrency investing. We particularly like the option to buy fractional shares.

By contrast, Moomoo is clearly designed for active trader investors who aren’t beginners, but have at least an intermediate level of experience. It offers advanced charting and Level 2 data, something that beginner investors may not understand or be able to use.

We like that Moomoo offers users access to the Hong Kong stock exchange. And as financial educators, we love that there’s an option for paper trading. If you sign up, you’ll get $1m of fake money to use as you figure out different trading options and how to structure your portfolio. Moomoo doesn’t offer cryptocurrency trading.

We should note here that neither platform offers bonds or mutual funds, both of which are important in portfolio balancing and diversification.

Pro Tip:

When you sign up for moomoo, you can earn up to 60 FREE STOCKS after qualifying deposits! Plus, with Robinhood you can refer friends to earn up to $1500 per year in FREE STOCK!

Moomoo vs Robinhood: Which Platform Is Better?

Both Moomoo and Robinhood have a lot to offer. Robinhood’s fees are slightly lower, while Moomoo offers more advanced features including charting options and paper trading. The user experience is good for both, but Robinhood’s is more streamlined and intuitive.

Overall, we recommend Moomoo for advanced and intermediate traders, while Robinhood shines for beginners and casual investors. You’ll need to decide which platform is best suited to your experience and investment style.

To see how Robinhood performs in comparison to another popular platform, check out WEBULL VS ROBINHOOD!

Want to take a more simple, streamlined approach to investing? Check out our new article: ROBINHOOD VS STASH: COMPARING FEATURES, FEES, AND SUITABILITY

FAQs

We think Moomoo is better than Robinhood if you’re an intermediate-to-advanced investor who wants access to a broad array of analytic and investment tools, as well as paper trading and the option to trade on the Hong Kong market. Robinhood is the preferable choice for beginners and casual traders.

No, Robinhood is not currently offering paper investing. If you’re willing to spend a little money, you can start building a portfolio with fractional shares. As you get accustomed to how the trading process works, you can buy additional shares.

Yes, both Robinhood and Moomoo are safe to use. Robinhood users’ accounts are protected by the SIPC and FDIC, and their website and mobile app have 2FA, end-to-end encryption, and the company has private crime insurance to protect users if their security is breached.

Moomoo is protected by the SIPC up to $500,000 per investment account. They also offer 2FA and encryption.