Managing your personal and business finances has never been more complex—or more essential. That’s where Quicken Simplifi steps in. Built for individuals, freelancers, and small business owners alike, Simplifi aims to bring clarity to your financial life in just minutes a week.

But is it the right budgeting app for your needs in 2025? In this Quicken Simplifi review, we break down its personal finance features, strengths and weaknesses, pricing structure, supported integrations, and how it compares to alternatives like Quicken Classic, YNAB, and Mint. We’ll also explore how well Simplifi fits the needs of modern users juggling personal and business budgets in a single interface.

What Is Quicken Simplifi?

Quicken Simplifi is a modern, mobile-optimized personal finance and money tracking app developed by Quicken Inc. The app focuses on streamlining budgeting, investment account tracking, and goal setting across all your financial accounts. It serves both individuals looking to manage household expenses and entrepreneurs needing to monitor business transactions.

Unlike Quicken Classic, which still relies on downloadable desktop software, Simplifi is 100% cloud-based. This allows users to log in from anywhere and manage bank accounts, credit cards, investment accounts, and even retirement accounts from a unified interface. There’s no software to install, and updates happen automatically.

Pro Tip:

Simplifi has some of the best personal finance tools out there, including savings, budgeting, and even portfolio analysis tools. Plus, you can get Simplifi annually for just 5.99 a month!

Key Features of Simplifi in 2025

Simplifi isn’t just a basic budget tracker—it’s a full-spectrum financial management tool that offers powerful capabilities for a range of user needs. Whether you’re managing deductible business expenses, tracking family income, or preparing for retirement, the platform is built for flexibility and speed.

Savings Goals

Simplifi helps users stay organized with flexible savings goals that are easy to create and monitor. You can set specific goals for vacations, emergency funds, down payments, and more. Each goal has a target amount and timeline, and users can allocate contributions from one or more accounts. These goals automatically integrate into your broader custom budget, ensuring you maintain progress without overspending.

Budgeting & Cash Flow Insights

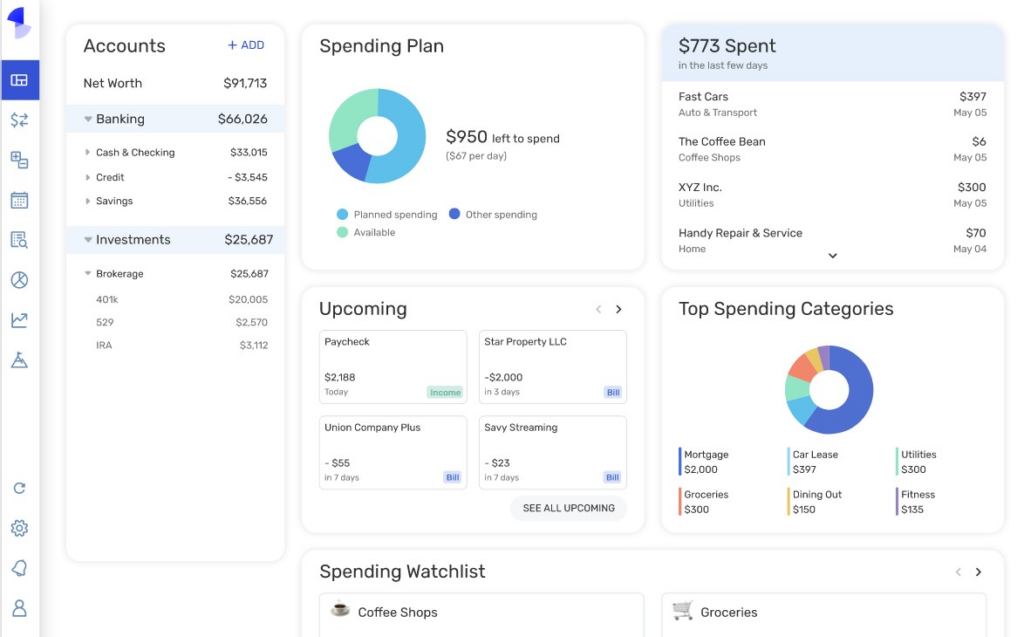

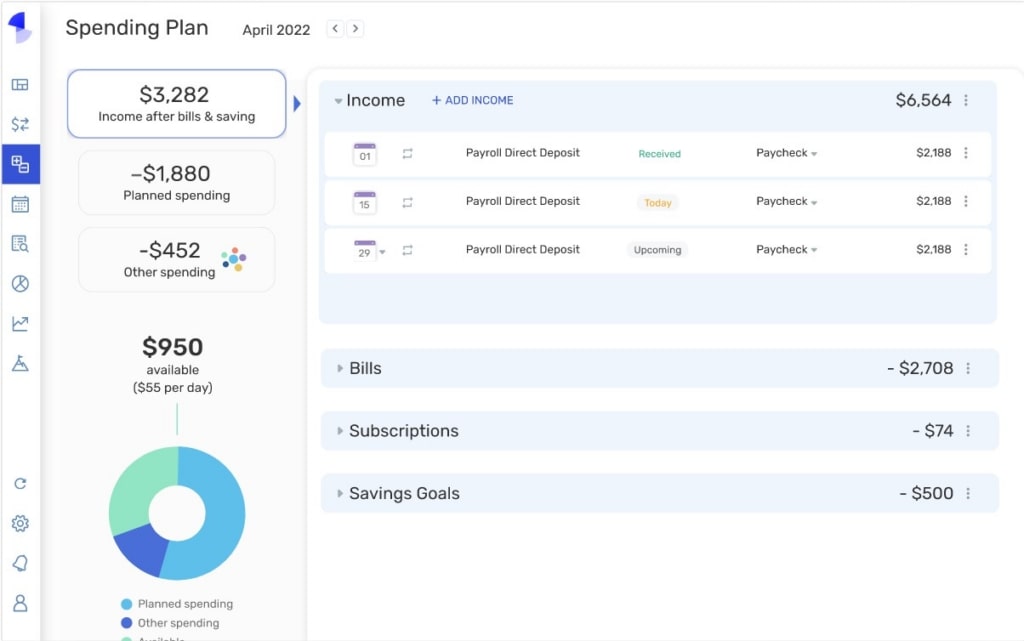

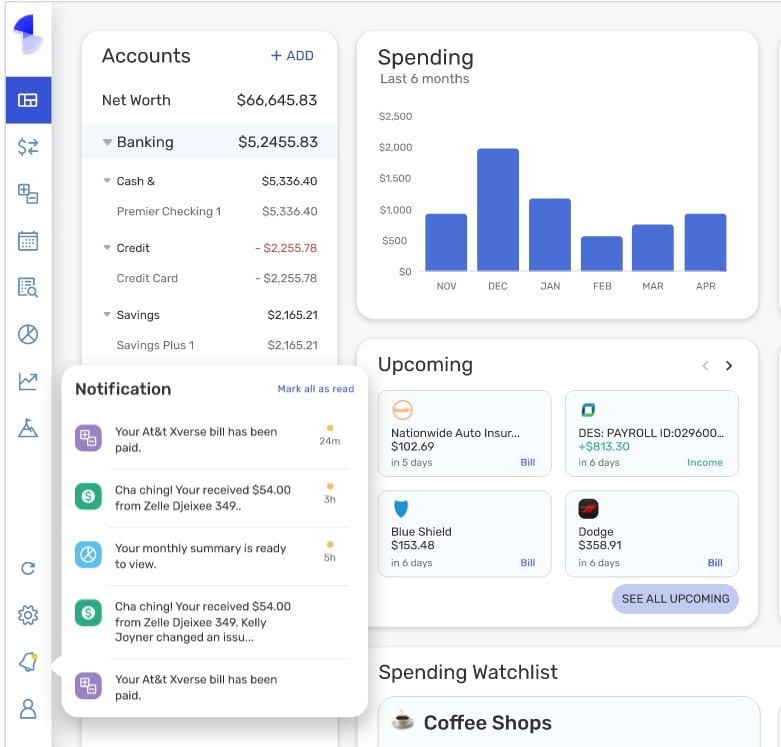

Simplifi provides a real-time view of your spending trends, projected cash flow, and upcoming bills. The dynamic spending plan adjusts daily, based on recurring expenses, income, and discretionary spending habits.

Simplifi also makes it easy to separate bills, subscriptions, and one-off purchases. Users can analyze spending by category, merchant, or timeframe, and get predictive insights into how current habits will affect net income over time. This granularity makes it an excellent fit for those seeking detailed oversight of both household and business budgets.

Investment Tracking

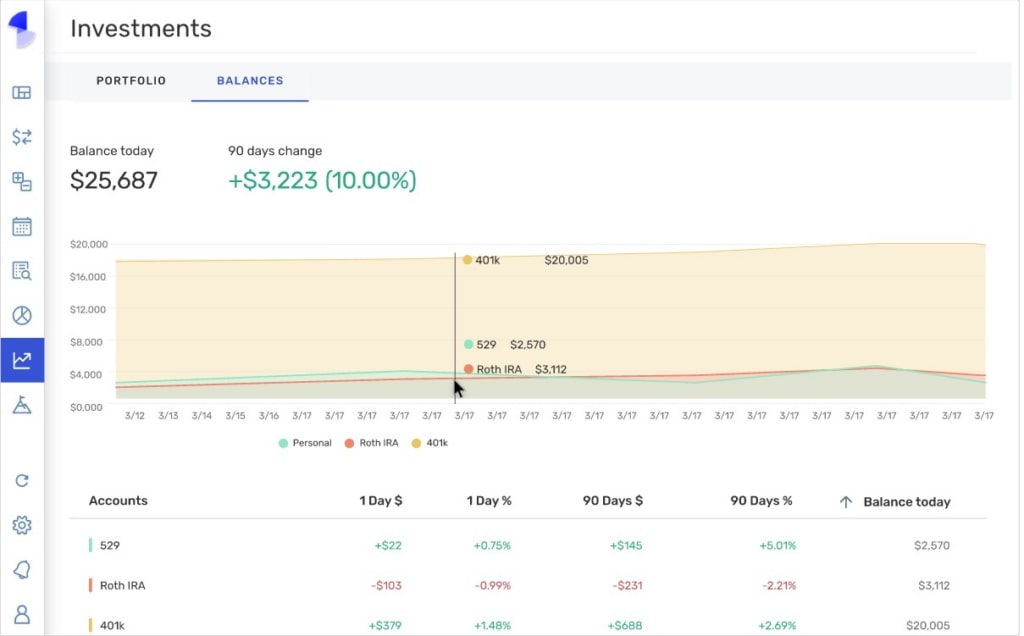

Simplifi connects to a wide range of investment accounts, from tax-advantaged IRAs and 401(k)s to brokerage accounts. The investments dashboard provides visualizations of asset allocations, returns over time, and market value fluctuations. It also includes curated news tied to your portfolio, which is especially helpful for DIY investors tracking long-term performance.

You can also manually add private holdings—like equity in a startup or rental properties—which gives you a complete snapshot of your current net worth. Simplifi won’t advise you on trades, but it does a great job centralizing your holdings and performance. For users interested in more advanced investment research, consider pairing Simplifi with a platform like Seeking Alpha.

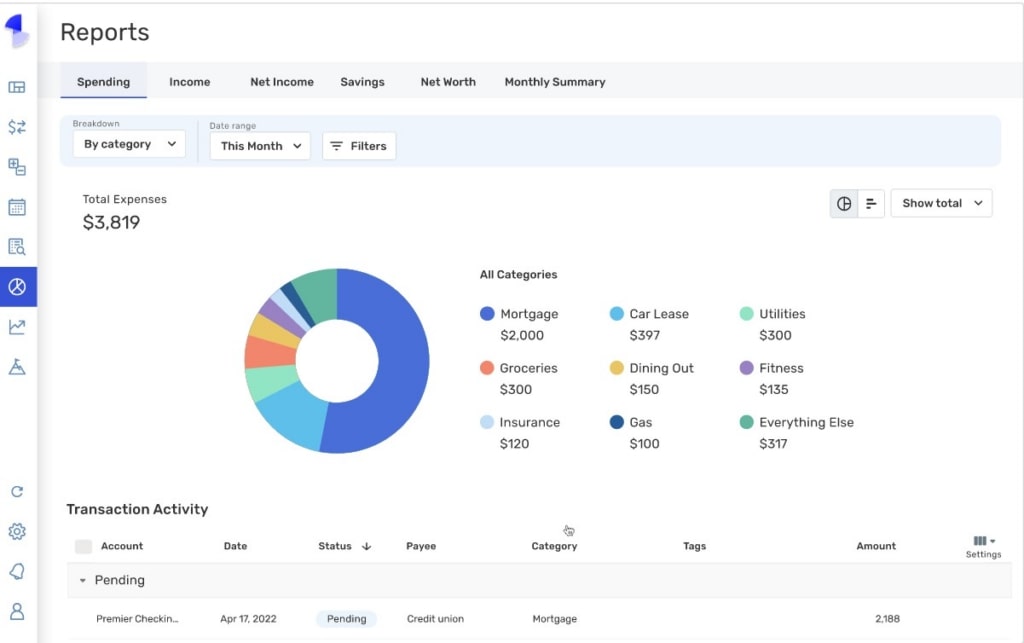

Reports and Custom Insights

Simplifi’s robust reporting tools help you break down finances by income, spending, category, and goal completion. You can view summaries monthly, quarterly, or annually and export data for use in tax prep or accounting software.

Its custom insights engine grows more powerful with use, learning your habits and offering personalized nudges: suggesting expense categories to trim, surfacing missed tax deductions, or flagging erratic spending spikes. For anyone working toward major goals, these insights provide critical feedback that can help improve long-term financial performance.

Quicken Simplifi for Small Business Owners

While Simplifi isn’t designed to replace QuickBooks or other full-featured accounting software, it covers the basics that many small business owners and freelancers need. These include income and expense separation, reporting, and basic tracking of business performance.

Simplifi allows users to separate business income from personal revenue, making it easier to track operations for tax and reporting purposes. You can monitor both recurring and irregular business transactions with ease. It also lets users assign and manage deductible business expenses with customizable labels and tags, which is particularly helpful when preparing annual returns. Users can tag and filter records for one or multiple businesses, and generate exportable reports to analyze business performance or to submit to an accountant.

It’s a smart solution for those running lean operations, side hustles, or sole proprietorships who want to avoid the learning curve and costs of more complex platforms. Users who need more robust business capabilities might still opt for a hybrid solution—Simplifi for day-to-day visibility and another tool for payroll, invoicing, or tax prep.

Pro Tip:

Organize your business and household finances. One platform. One view get started with Simplifi for just 5.99 a month!

Is Simplifi Safe?

Security is top-of-mind for any tool syncing your bank accounts and sensitive financial data. Thankfully, Simplifi uses industry-standard 256-bit encryption, offers multi-factor authentication, and never sells your data.

Because it’s built and maintained by Quicken Inc., Simplifi benefits from enterprise-grade security policies and years of infrastructure development. All updates occur server-side, reducing the risk of vulnerabilities, and Simplifi’s ad-free model means its revenue comes directly from subscriptions—not from mining your behavior.

Whether you’re linking retirement accounts, checking investment dashboards, or comparing business and personal budgets, you can trust the platform’s data privacy measures.

Simplifi Pricing (Updated for April 2025)

Simplifi offers a single plan with two payment options:

Monthly Plan: $5.99/month, cancellable at any time.

This pricing includes a comprehensive set of features for users. Subscribers gain unlimited linking of financial accounts and category tracking to help streamline their financial views. Additionally, the subscription unlocks access to all core tools—ranging from budgeting and savings tracking to detailed spending reports—and ensures that everything syncs seamlessly across iOS, Android, and web platforms.

Pros and Cons of Simplifi

Every app has its strong points—and its trade-offs. Here’s a closer look at where Simplifi shines and where it might fall short, depending on your financial goals and daily needs.

Pros

Simplifi delivers value in several key areas. It’s designed for users managing both personal and business finances, and its intuitive interface makes onboarding quick and easy. Smart categorization and alert systems help users stay informed, while mobile and web compatibility ensure you’re never far from your financial data. Simplifi also offers curated investment summaries, performance snapshots, and timely alerts for irregular activity. It operates with a transparent, ad-free business model built around data security.

Cons

However, Simplifi does have its limitations. It lacks full support for professional invoices, payroll, and advanced accounting tools like double-entry journals. The app isn’t built for multi-user access, which could be a drawback for couples or teams managing shared finances. And while the pricing is competitive, it may not appeal to those seeking a free version like Mint.

Simplifi is, as the name suggests, a very simple tool to use and understand. Quicken (read: QUICKEN REVIEW) offers more advanced features for business owners and entrepreneurs, but it is more expensive.

Pro Tip:

Ready to simplify your finances? Start with Simplifi now and see the difference!

Who Should Use Simplifi?

Simplifi is an ideal solution for freelancers, solopreneurs, and busy professionals looking for more control over business and personal finances. If you want to link all your accounts, build long-term financial goals, and avoid time-consuming spreadsheets, Simplifi offers a sleek, data-rich solution.

That said, it may not be the best fit for larger businesses needing payroll tools, investors looking for deep analytics, or those simply wanting a free app to track their budget.

Final Verdict: Is Quicken Simplifi Worth It?

Whether you’re focused on debt payoff, maximizing your savings rate, or simply gaining a clearer view of where your money goes, Simplifi stands out as one of the best modern tools available. It delivers excellent value for the subscription fee, especially when compared to competitors like YNAB or PocketGuard.

If you’ve struggled with complex Excel sheets or confusing apps in the past, Simplifi’s clean interface and automation will feel like a refreshing change. It’s a straightforward, mobile-first solution that doesn’t sacrifice functionality.

There’s very little reason not to give it a try. If you’re looking to simplify your financial life—whether you’re tracking business revenue or family savings—this app could be exactly what you need.

FAQ

Yes. Simplifi helps users track business income, categorize deductible business expenses, and generate financial summaries.

Yes. You can connect thousands of bank, credit, investment, and retirement accounts to maintain a unified dashboard.

Correct. It operates via browser and mobile app. There’s no separate desktop download.

Yes. It shows high-level performance metrics, diversification snapshots, and news tied to your holdings.