In this Stash review, I’ll give you all the cold hard facts and you can decide if it’s better for you than Acorns. (Read our full Acorns review here.)

Stash is more than just a platform to buy stocks—it’s a full-spectrum personal finance app that combines investing, banking, budgeting, and education in one place. Designed especially for beginner investors, Stash aims to simplify complex financial processes while empowering users to build long-term wealth. With its unique combination of automated investing, fractional shares, stock rewards, and personalized guidance, Stash supports users at every step of their investment journey.

In this refreshed and expanded review, we’ll break down everything from Smart Portfolios to retirement accounts, explain pricing structures, and help you decide whether Stash is the right fit for your financial future.

What Is Stash?

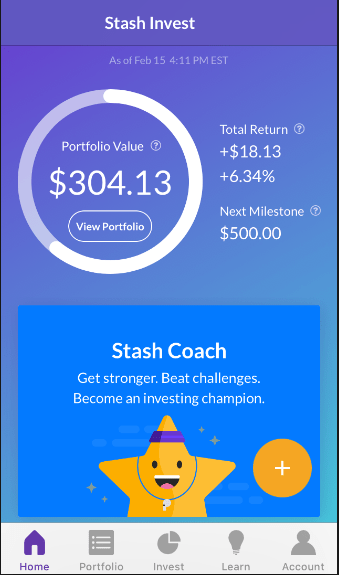

Stash is a SEC registered investment adviser and wealth-tech company built for everyday Americans who want to take charge of their finances and financial goals with automated investing and a bank account. With no need for a large upfront investment, users can get started with as little as $5 in their brokerage account. Stash has been developed with a clear mission: make investing more inclusive, less intimidating, and easier to navigate for people of all financial backgrounds.

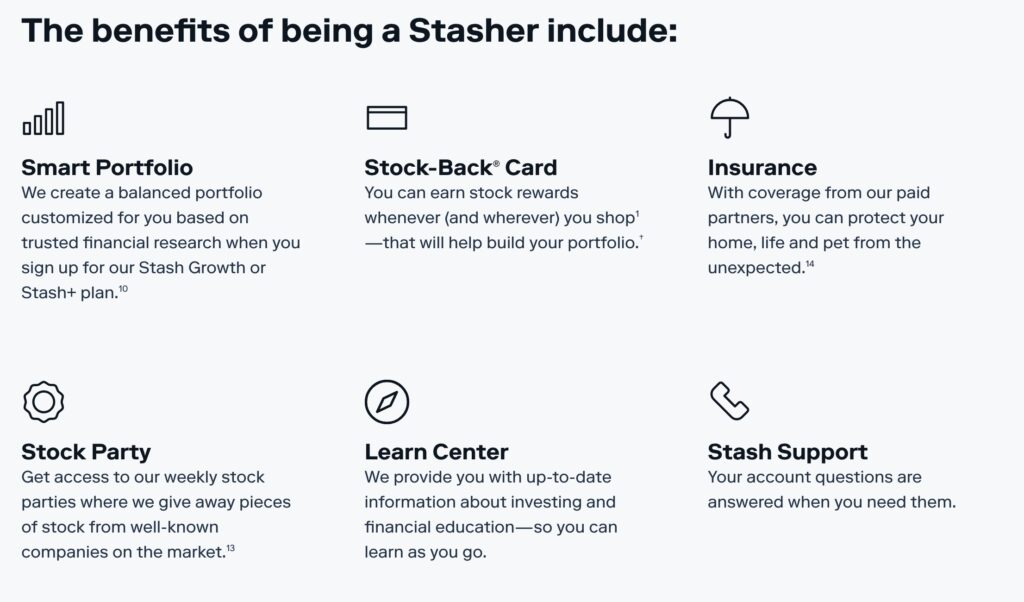

The platform combines a personal brokerage account, tax-advantaged retirement plans, Smart Portfolio for automated investing, and cash management tools like a connected bank account and debit card. Through its banking and investing ecosystem, Stash provides an accessible entry point into financial markets, budgeting strategies, and wealth-building practices (including recurring investments).

In addition, users can earn stock rewards on everyday purchases made with their Stash debit card—a feature that aligns spending habits with long-term financial growth in their investment accounts.

Investment Options and Features

Stash offers a wide variety of ways to invest and build a portfolio, whether you’re a beginner who prefers automation or someone who wants to handpick each asset; it’s the perfect place for brokerage and banking accounts. Here’s a breakdown of the platform’s investing capabilities:

Smart Portfolio: Automated Investing That Grows With You

At the heart of Stash’s robo-advisor experience is the Smart Portfolio feature. This tool builds a diversified investment portfolio tailored to your risk tolerance, goals, and socially responsible options. It uses automation to rebalance your portfolio periodically and ensures your investments align with your chosen strategy, whether conservative or growth-focused.

You don’t need to worry about selecting individual stocks. Instead, the algorithm places your funds in ETFs across different sectors and risk levels, offering a hands-off way to grow your wealth. You’ll also receive educational nudges that explain how and why your portfolio changes over time.

Pro Tip:

Start your investing overhaul with Stash today for just $5!

Self-Directed Investing: Build Your Own Portfolio

For investors who prefer more control, Stash offers access to individual stocks, ETFs, and mutual funds, including the ability to purchase fractional shares. This means you can own part of companies like Amazon or Apple without needing hundreds of dollars.

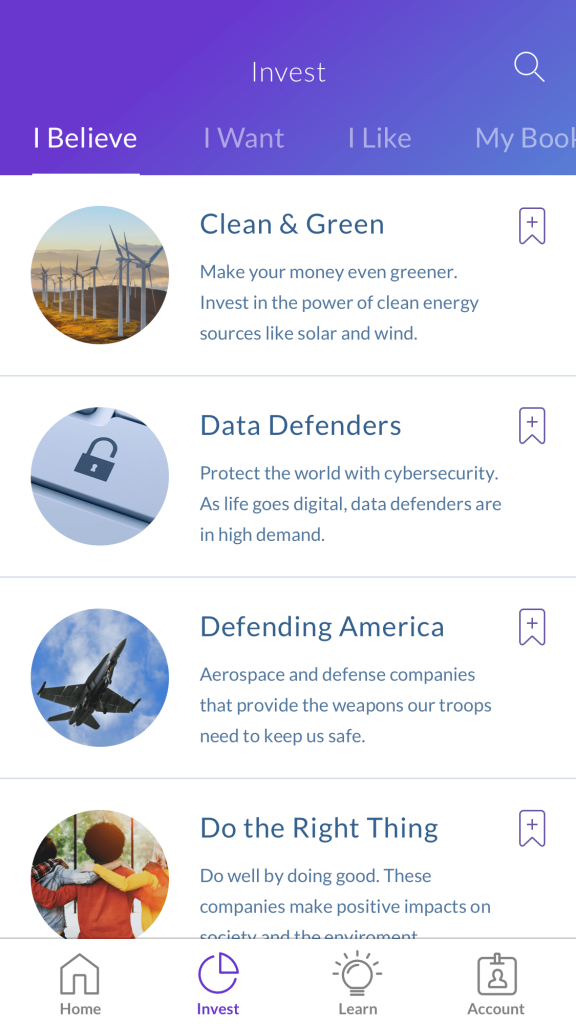

Stash’s in-app investing guidance includes educational articles, curated investment themes (like environmentally focused funds), and regular market insights. Users can filter assets by risk, category, or industry and build a personalized portfolio aligned with their values and interests.

Other Investment Features

- Access to recurring investments to stay consistent

- Option to explore socially responsible investing strategies

- Simple rebalancing and progress tracking tools

Accounts and Services

Stash supports several types of investment accounts that suit different financial needs and life stages. A personal brokerage account is ideal for building a flexible portfolio with access to stocks, ETFs, and mutual funds. For long-term savers, Stash offers both Traditional and Roth IRAs, helping users grow their retirement savings with tax advantages. Additionally, Stash provides custodial accounts (UGMA/UTMA), allowing parents or guardians to invest on behalf of their children.

Every account includes access to Stash Banking, where users can set savings goals, track expenses, and use the Stash debit card to earn stock back rewards. It all feeds into one dashboard, making it easy to see your money at work.

Personalized Tools for Smarter Money Management

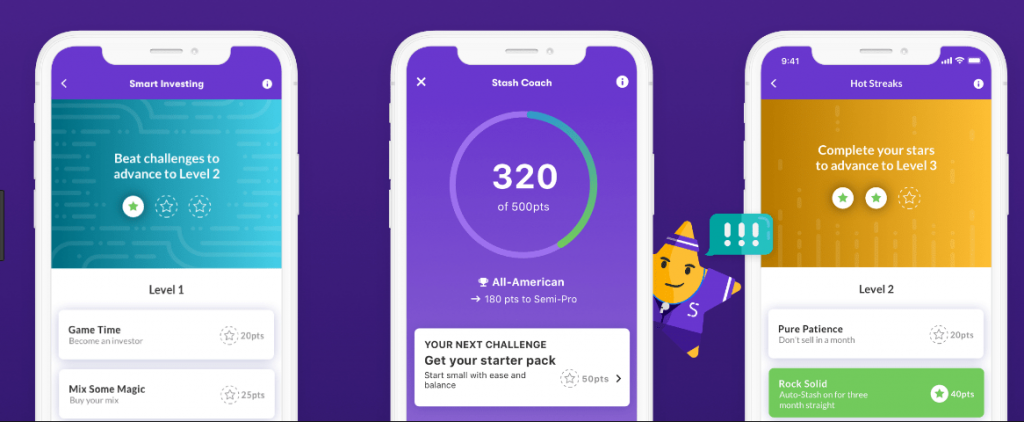

Stash doesn’t stop at investing. It also includes a suite of tools designed for smarter money management. Users can track income and expenses through in-app budgeting features and set specific goals using built-in dashboards. The Auto-Stash function allows for recurring deposits, making it easier to stick to savings plans without constant effort. To support continuous learning, Stash provides a wealth of educational resources that match users’ skill levels—from basic financial literacy to advanced investing strategies.

These features make Stash a true personal finance app, rather than just a brokerage account. It’s especially helpful for users who want to understand how to budget, invest, and grow their money—all in one place.

Pro Tip:

Download the app today and get started with as little as a $5 deposit!

Pricing and Subscription Tiers

Stash offers clear and transparent monthly subscription fees with no hidden costs or commissions. There are two primary plans:

- Stash Growth – $3/month: Includes brokerage and retirement accounts, Smart Portfolio access, and banking features.

- Stash+ – $9/month: Includes everything in Growth, plus custodial accounts for kids, personalized guidance, market insights, and higher rewards earnings.

Unlike other platforms that charge trading commissions or require high balances, Stash is approachable for those with limited capital. The subscription fee covers investment advisory services, portfolio tools, and access to financial education.

Security, Regulation, and Account Protection

Stash is regulated by the U.S. Securities and Exchange Commission (SEC) and is a registered investment advisor. Investments are protected by the Securities Investor Protection Corporation (SIPC) for up to $500,000. Banking services are provided by partner banks and are FDIC insured for up to $250,000.

Additional security measures include:

- Two-factor authentication

- Bank-level encryption

- Account activity monitoring to detect unusual transactions

Your money and data are protected, and you’ll always have access to transaction logs, statements, and disclosures through the app.

Getting Started with Stash

Signing up with Stash takes just a few minutes. After downloading the app, users answer a few onboarding questions about their goals and risk tolerance. The app then recommends a Smart Portfolio or guides users to build their own.

You can begin investing with as little as $5, and once your account is funded, you’ll be able to make trades, set up automatic deposits, or explore investment topics in the learning center.

New users also receive tips, reminders, and updates that encourage good financial habits. Plus, the Auto-Stash feature helps users contribute consistently over time.

Pro Tip:

Take the first step toward financial freedom with a $5 deposit with Stash.

Is Stash the Right Choice for You?

If you’re looking for a simple, approachable platform that teaches you how to own investments, save money, manage your money, and plan for the future—all from one app—Stash is a great fit. The monthly subscription fee covers a lot: personalized advice, investing tips, retirement tools, rewards, and beginner-friendly automation.

While advanced investors may eventually need more technical features, investing tools, or lower-cost options, Stash is an ideal platform for:

- Beginners seeking hands-on investing guidance

- Parents managing family finances and looking for kids portfolios

- Individuals wanting both banking and investing in one place

- Those looking for a “set it and forget it” retirement portfolio

- Anyone needing help aligning financial goals with their daily habits

It’s not bank guaranteed, and like all investing, there are risks. But for many users, Stash provides the educational tools, structure, and flexibility needed to build a better financial future; Stash makes smart investing easy.

Each portfolio details risk level, performance history, and the holdings. You can also see what the underlying investment is for any themed investment.

FAQ

Yes. Stash simplifies the investing process with education, automation, and accessible features designed for first-time users.

Yes. The Smart Portfolio tool automates your investment based on your risk level and goals.

Stash Growth is $3/month, and Stash+ is $9/month with expanded features.

Yes. Use the Stash debit card to earn stock rewards on everyday purchases.

Absolutely. It’s SEC-regulated and offers SIPC and FDIC coverage for invested and stored funds.