Having a good credit score is like holding a master key to financial opportunities, unlocking doors to mortgages, car loans, and better employment prospects. That’s why tracking your credit health is essential, and TransUnion aims to make the process straightforward.

TransUnion, alongside Equifax and Experian, is one of the three major credit bureaus responsible for compiling consumer credit information and credit scores (read: WHAT FACTORS AFFECT YOUR CREDIT SCORE?). This review delves into whether paying for TransUnion’s credit monitoring service truly benefits your financial life.

What is TransUnion Credit Monitoring?

TransUnion Credit Monitoring is a subscription-based service providing consumers continuous, real-time updates on their credit status. While every consumer can receive a free annual credit report, the growing threat of identity theft has made ongoing credit monitoring increasingly popular. Let’s ask the question: can TransUnion help keep all my personal information safe?

Pro Tip:

Protect what matters. Get $1 million in identity theft insurance and comprehensive credit tracking. Join TransUnion now!

Key Features of TransUnion Credit Monitoring

TransUnion’s service offers a comprehensive set of tools designed to keep your credit secure and help you manage your financial health effectively. Here are the primary features explained in detail:

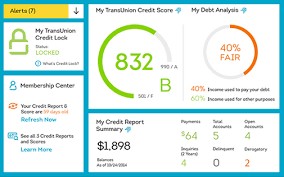

24/7 Access to Reports & Scores

Subscribers gain around-the-clock access to their TransUnion and Equifax credit scores, including daily updates reflecting recent changes. This constant visibility ensures you’re always informed and can take timely actions if needed.

Pro Tip:

Are you or your family active duty military personnel? TransUnion is offering a free credit monitoring service for all those in service of our country. Click here to get started with TransUnion today!

Real-Time Alerts & Notifications

You’ll receive alerts in a timely manner about critical changes or suspicious activity across all three major credit bureaus, helping you react quickly to potential fraud. These immediate notifications empower consumers to address potential issues before they escalate.

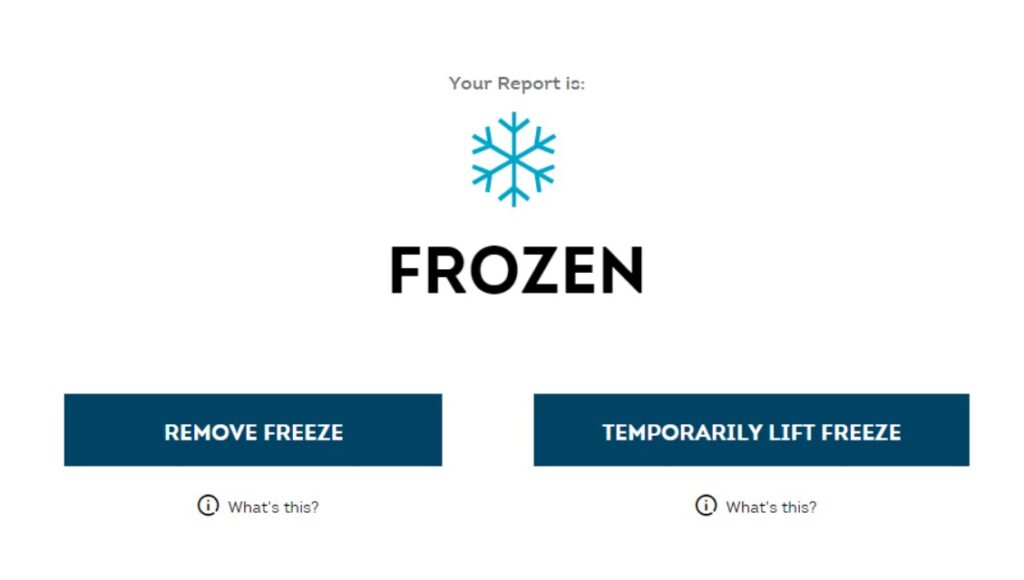

Flexible Credit Lock Feature

Unlike traditional credit freezes that may take hours to activate, TransUnion provides instant toggling of credit locks for both your TransUnion and Equifax reports, giving you immediate control over who accesses your personal credit information. This flexibility is especially useful when you’re applying for loans or credit cards.

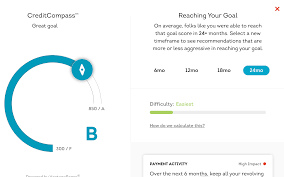

Personalized Credit Advice with CreditCompass™

CreditCompass™ guides you through the process of improving your credit score by setting personalized goals and providing actionable insights tailored to your unique financial profile. By following these customized recommendations, you can accomplish your credit score objectives more efficiently.

Pro Tip:

TransUnion is a credit monitoring service that offers unlimited reports, instant fraud alerts, and personalized debt analysis. Click here to get started with TransUnion today!

Identity Theft Protection

Given the 5.7 million fraud reports in 2023 alone, protection is crucial and seems almost impossible. TransUnion includes $1 million in identity theft insurance and comprehensive support to navigate recovery from fraud, offering users peace of mind.

Is the TransUnion Service Worth the Money?

At $29.95 monthly (about $359 annually), the TransUnion monitoring service isn’t cheap, but its comprehensive features offer substantial value. Unlike some competitors, TransUnion provides combined access to both TransUnion and Equifax scores and reports, setting it apart in the credit monitoring industry.

How Does TransUnion Compare to Other Services?

TransUnion vs. Experian IdentityWorks

While Experian’s Basic Plan is free, it covers only Experian reports. Experian’s Premium Plan at $24.99/month includes all three bureaus, similar to TransUnion’s offering but without Equifax credit locking.

Verdict: If locking Equifax and TransUnion simultaneously matters to you, TransUnion edges ahead with its enhanced locking capability.

TransUnion vs. LifeLock

LifeLock, partnered with Norton, initially seems cheaper but significantly hikes fees after the first year. Additionally, LifeLock’s lower-tier plans lack robust protections offered by TransUnion.

Verdict: TransUnion’s consistent pricing and comprehensive set of features make it the superior long-term choice.

Is TransUnion’s Credit Monitoring Service Worth the Money?

It’s time to answer the burning question: is it worthwhile to spend your money on TransUnion Credit Monitoring?

On the whole, we believe that TransUnion is a good value?. You’ll get full access to both TransUnion and Equifax credit reports and scores, immediate notifications of suspicious activity, the ability to toggle credit lock off and on, and up to $1 million in identity theft protection.

We like TransUnion’s mobile app, which is easy to use. You can get in-app support, view reports, and much more.

One thing that sets TransUnion Credit Monitoring apart from other credit monitoring services is CreditCompass™. If you’re looking to both protect and repair your credit, then TransUnion’s service will help you set a credit score goal and teach you what to do to improve your score.

Conclusion

Overall, TransUnion Credit Monitoring is a compelling and worthwhile investment for proactive credit management and robust identity protection. Its user-friendly app, instant credit locks, and personalized tools like CreditCompass™ offer considerable advantages that simplify and enhance the consumer’s credit monitoring and requests experience. While the cost is slightly higher than some competing services, the depth and quality of the features provided justify the premium, creating a great customer experience.

Whether you’re actively working to improve your credit score, safeguarding your identity, or simply seeking greater peace of mind without fear, TransUnion’s comprehensive service covers all the critical aspects of credit protection and improvement. Its transparent pricing, combined with extensive fraud protection and personalized recommendations, make it a standout choice in the credit monitoring market and to help avoid financial mistake.

If you are looking for a full service online financial suite for products like checking, credit cards, and personal loans to compliment your credit monitoring services, Upgrade (read: UPGRADE REVIEW) is a compelling new fintech player that may just have all of your banking and credit needs.

Yes, you’re entitled to one free annual credit report from each bureau under the Fair Credit Reporting Act.

Instantly. The credit lock feature activates immediately, unlike a traditional credit freeze, which may take up to 24 hours.

Yes, TransUnion’s service includes monitoring and alerts from TransUnion, Equifax, and Experian.