Whether you are a trader or an investor, your goal is to make money.

Your secondary goal is to accomplish that goal without taking unnecessary or uncomfortable risks.

Most people know that the key to making money is buying low and selling high.

One of the tricks of experienced stock traders is to not buy stock.

Instead, experienced traders will buy options.

In investing, options have certain characteristics that cannot be found elsewhere in the investing universe.

In this Webull options review, you will learn:

- What are Webull options?

- Why trade options?

- How to trade options on Webull?

- What are the advantages and disadvantages of trading options?

- Why should you trade options with Webull?

- How do you get two stocks on WeBull ABSOLUTELY FREE?

By the end, you’ll know what options are, how to trade options, and where to trade options.

Pro Tip:

Get 20 free fractional shares on Webull when you deposit $500 or more today!

Webull Overview

Let’s start with our Webull platform overview.

Webull hit the market in 2018 and has been killing it ever since.

Webull is regulated in the U.S. by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and is a member of the Securities Investor Protection Corporation (SIPC)

All you need is a smartphone or access to the web (compatible with iOS and Android) and an account. (Webull used to be only a trading app, but they now have an online website and you can trade there if you prefer.)

Similar to our friends over at Robinhood…

…Webull offers zero-commission trades and no account minimum.

You can make unlimited free trades of stocks and ETFs.

However, Webull departs from Robinhood in many ways.

Previously, we told you that Webull offers free advanced trading tools.

These tools are far superior to anything that Robinhood provides for trading options.

To get the full comparison, read: WEBULL VS ROBINHOOD.

With Webull, you gain access to:

- Up-to-date news to keep you current on the latest events.

- Real-time market data to give you the most accurate information for decision-making.

- Analysis tools to allow you to make the best possible decision.

However, if you are a loyal reader, you likely know all of this information!

Webull was lacking something the last time we looked into the company.

What was that one thing?

OPTIONS.

You could not trade options on a trading account.

If you are reading this today, the above statement is no longer true.

You can now trade options with Webull.

Pro Tip:

Get 20 free fractional shares on Webull when you deposit $500 or more today!

But if you are new to stock trading, perhaps you have no clue what options and extensive educational resources can do for you.

So, let’s cut the chit-chat and get down to business.

Unleashing the Power of Options on Webull

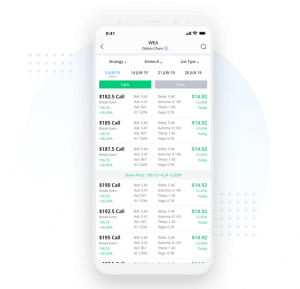

Options give you the right to buy (call option) or sell (put option) an asset at a pre-set price before your contract expires.

So, why would you want to trade options, anyway?

Options are powerful tools that can enhance your portfolio by adding both income and protection.

Here are the essentials of options trading:

- Call Option. Allows you to buy shares of stock at a specific time.

- Put Option. Allows you to sell shares at a specific time.

Options Trading Unpacked: Flexibility, Leverage, Hedging, and Income Generation

Options trading is a form of derivative trading where you have the option to buy or sell an asset at a predetermined price for a set period.

Let’s examine some of the key Webull options strategies that you can use.

- Flexibility is something that’s built into futures trading. As noted above, you have the choice of placing a call or a put. A call allows you to capitalize on a price increase, while a put allows you to capitalize on a decrease. You can earn money either way.

- Leverage means that you can invest a small amount of money in options and earn an outsized profit if you do it right. Of course, that works the other way too, meaning that if the stock you choose doesn’t perform as expected, you could lose more than you would with a simple stock purchase.

- Hedging is a way to protect yourself against risky investments. Because you can earn money if the stock price rises or falls, you’ve got a bit of insurance you wouldn’t have otherwise.

Navigating the Options Landscape: Contracts and Interface Insights

Webull options contracts take several different forms. Here’s a breakdown.

- EFT options

- Index options

- Equity options

- Vertical options spreads (the simultaneous buying and selling of options of the same type)

- Iron condor (a complex options trade that involves two puts, two calls, and four strike prices)

The options trading process on Webull is simple. Assuming you’ve already set up an account, all you need to do is research which options you want to buy and place your order.

One final note here: you’ll need a margin account if you plan to buy more advanced option types, such as the iron condor.

Mastering Risk with Webull’s Unique Tools

One of the reasons we like Webull for options trading is that they offer some unique Webull risk management tools that can help you manage your risk and make profitable trades. These include:

- Market scanners and screeners

- Webull Mobile App

- Customizable charting, including candlestick, line, and bar charts; drawing tools, Fibonacci retracements, and more

- Paper trading (a great way for beginners to learn about options trading)

- Custom alerts

- Webull Account

You also have the option to trade directly from charts, something that’s unique to Webull.

Webull Platforms vs. the World: Comparative Platform Analysis

Here’s a Webull comparison with some other platforms where you can trade options, so you can see which platforms offer the best features and value.

Direct Feature Face-Off: Webull vs Competitors

How do Webull’s features compare with competitors? Two of the other platforms where you can trade options are E*TRADE and Interactive Brokers.

|

Webull |

E*TRADE |

Interactive Brokers | |

|

User-friendly platform |

Yes |

Yes |

No |

|

Advanced charting |

Yes |

Yes |

Yes |

|

Commissions |

No |

No |

Yes |

|

Lower Fees for active traders |

No |

Yes |

Yes |

|

Paper trading |

Yes |

Yes |

Yes |

Cutting Costs, Maximizing Value: Webull’s Efficiency Examined

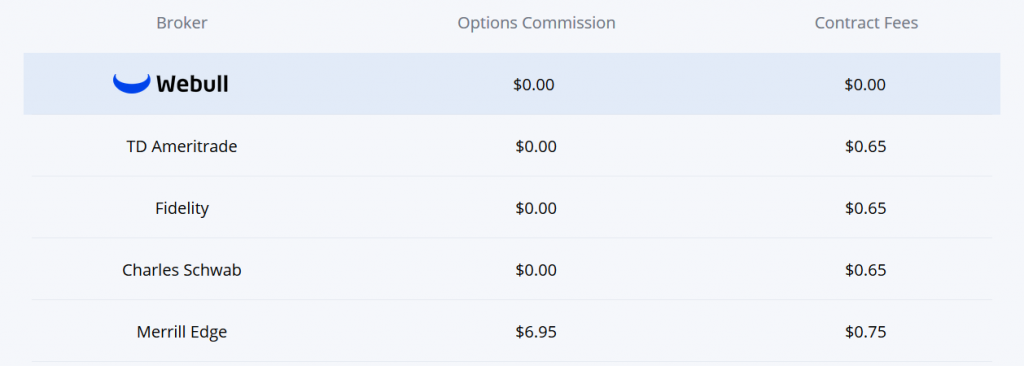

Webull has affordable prices for options trading. There are some platforms that offer lower prices for active or high-volume traders. Here’s our Webull fees comparison.

- Webull fees: $0.65 per options trade and $0.55 per index option; $13.00 for 20 trades; $0.10 per options contract for options orders of above 500 contracts (does not apply to index options)

- E*TRADE fees: $0.65 per options trade; $.50 for 30 or more options trades per quarter

- Interactive Brokers: $0.65 per options trade for IBKR Lite; as low as $0.10 per option for high volume traders on IBKR Premium.

You’ll notice that a charge of $.65 per options contract is standard.

Real User Insights: Webull Options Trading Reviews

Webull has mostly positive reviews overall. Here’s a quick snapshot.

- Investopedia: 4.2 out of 5 stars

- TradingView: 4.5 out of 5 stars

- Apple Store: 4.7 out of 5 stars

- Google Play Store: 4.5 out of 5 stars

Users say that they like the easy-to-navigate interface and low-cost options trading. Beginners have also noted that they appreciate that Webull offers options paper trading practice where new options traders can learn the ropes.

There are a few complaints about Webull, with the most common one being that their algorithm may update prices in the middle of a trade, making it, at times, a less advantageous trade. Our take would be that you can always cancel the trade and restart it based on updated information, even on options paper trading practice.

There are also some people who have had issues with slow customer service response times on the Webull app. To offset that, there are also Webull user reviews in the two app stores where users have praised customer service.

Your Trading Ally: Webull’s Support and Learning Tools

When choosing a trading platform, having reliable customer support and access to extensive educational resources is essential—especially for options traders looking to build confidence in executing trades. Webull stands out as a platform that offers both, making it an excellent choice for traders of all experience levels. Whether you are setting up your Webull account, learning about options strategies, or using paper trading to refine your approach, Webull provides the tools to help you make informed trading decisions.

Immediate Support for Options Traders

A strong customer support system is crucial for any trading platform, particularly when dealing with the complexities of options trading. Webull offers trading account assistance through phone and email support. However, the lack of live chat support can be a drawback for traders who need immediate help. While there is a “Feedback” option on the Webull mobile app, responses are handled via email and typically take up to 24 hours.

For traders who need quick solutions, calling Webull’s support line during business hours is the best option. This is particularly important for options traders managing trades with tight expiration dates or monitoring a stock’s price in real time. Whether you are adjusting your trading strategy, troubleshooting an issue with your Webull account, or learning how to execute complex trades, having access to fast support can make a significant difference.

Webull’s support is also useful for traders who are new to the platform and need help setting up their trading password, configuring options search filters, or understanding the features of the Webull app. With customer assistance available, traders can focus on refining their market approach rather than dealing with technical roadblocks.

Advancing Your Trading Skills with Webull

One of Webull’s standout features is its commitment to providing traders with extensive educational resources. The Webull learning center offers in-depth guides on everything from stock trading basics to advanced options strategies. New traders can find step-by-step instructions on how to start trading, set a strike price, and understand expiration dates. More experienced traders can explore complex equity options strategies, market dynamics, and how to use options pricing models to optimize their trades.

A key advantage of Webull is its options paper trading practice feature. This allows traders to test their strategies in a risk-free environment before placing real trades. Paper trading lets users execute different types of options trades, including put options and index options, without risking actual capital. This is particularly beneficial for those who want to experiment with options chain analysis, options screeners, and risk tolerance adjustments before transitioning to live trading.

Webull’s paper trading feature closely simulates real market conditions, helping traders develop a stronger grasp of stock trading mechanics. Whether you want to practice setting price alerts, use advanced options trading strategies, or test your ability to view market depth, Webull’s tools give you hands-on experience in a live trading arena without the financial risk.

Additionally, Webull platforms offer comprehensive tools that help traders enhance their market awareness. Traders can access real-time data, quickly execute entry orders, and enable options trading through Webull’s user-friendly interface. The platform also provides options pricing data, allowing traders to compare strike prices and expiration dates while refining their trading strategy.

Making the Most of Webull’s Features

Webull’s combination of educational resources and trading tools makes it a great choice for traders who want to improve their market knowledge and execution skills. The ability to practice with a Webull account using paper trading before committing real money helps traders build confidence. Meanwhile, the availability of customer support ensures that users can get assistance when needed—whether it’s troubleshooting a trading password issue, understanding the options chain, or navigating the Webull mobile app.

For those looking to gain a deeper understanding of trading options, Webull provides extensive educational materials and a live trading experience that helps traders make informed decisions. By using Webull’s features to their full potential, traders can develop a solid trading strategy, minimize risks, and optimize their trades for long-term success.

The Pros and Cons of Options Trading with Webull

Here are some Webull options pros and cons for you to consider before you dive into options trading.

Let’s start with the pros:

- You don’t need to pay for the stock itself and options are considerably less expensive in most cases.

- Options are cost efficient and provide serious leveraging power.

- As an investor, you can purchase an option position similar to a stock position.

- You can hedge your investments to protect yourself against unnecessary risk.

- You can earn a higher return with a successful options trade than with a stock trade for the same asset.

- Options are a strategic option to investing in equity.

Here are a few cons to keep in mind:

- The downside is purchasing options that expire without being exercised.

- When not properly understood, options can be a waste of money.

- Options can produce greater losses (i.e., you lose 100% of your investment when the option is not exercised).

You should consider both the pros and cons of options trading before initiating your first trade.

Pro Tip:

Get 20 free fractional shares on Webull when you deposit $500 or more today!

Get Started with Webull: Sign Up and Earn Free Stocks

Who wants to trade options on Webull?

Answer: Everyone!

When trading options online through traditional brokerages…

…most brokers charge a base per-trade fee and a per-contract fee.

From there, most brokerages charge an exercise fee when you decide to exercise your option.

If that’s not enough, brokerages also charge an assignment fee when your option is sold or bought.

With all these fees, is trading options worth it?

Well, it depends who you use as your brokerage.

With Webull, you can trade options for a single low fee of $0.65 per option. There are:

- NO commission

- NO assignment fees

- NO exercise fees

Signing up for Webull is extraordinarily easy.

Simply use your phone number or e-mail address.

The Webull mobile app is available on iOS and Android.

From there, you provide the standard brokerage account information.

This information includes your name, address, Social Security Number, etc.

You will also need to provide identification, either a driver’s license or passport.

Once these steps are complete, you can access your account in minutes.

The best part about the sign-up process is that there is no financial commitment to receive your share of free stock.

That is right – no minimum deposit, no trades, and no banking information.

The only thing you need to do is get your account OPEN.

What do you have to lose in this scenario?

I will answer for you – nothing!

Furthermore, there is never a minimum account balance required for your account.

WeBull is currently running a promotion that allows you to get 2 stocks, absolutely free.

All you have to do is sign up for a WeBull account to get your first free stock.

Then, deposit any amount of money to receive your second free stock.

That’s all it takes!

So what are you waiting for? Head over to WeBull now to get your two free stocks!

FAQs

Yes! We really like Webull for options trading. Their prices are in line with other digital trading platforms. They have a nice collection of educational content to help users learn about options trading. They also offer paper trading, which allows investors to practice options trading before they use real money.

Webull’s standard charge is $0.65 per options contract, which works out to $13.00 for 20 contracts. The charge is $0.55 for index options. If you place an order for 500 or more options trades, the charge is only $0.10 per contract, which doesn’t apply to index options.

Webull comes out on top in most comparisons. Their price for volume (500+) options is low compared to other trading platforms, while their regular price is right in line with what others charge. Their educational content, plus the availability of paper trading to practice options trading, puts them ahead of most other platforms.

Webull has educational resources that cover all aspects of trading, and options trading is no exception. There’s a library of articles covering topics from basic (What is options trading) to advanced (Selecting Expiration for a Cash Secured Put Strategy). People who are interested in learning how options trading works can also use Webull’s paper trading tool to test out different trades before they use real money for options trading.

The first step to trading options on Webull is to sign up for an account and verify your identity. Once your account is verified, you’ll need to make your first deposit. If you’ve never engaged in options trading before, we would recommend that you practice with paper trading. Once you’re ready to buy your first options contract, you can do it by clicking Trading and Investing on the menu and then choosing Options. From there, you’ll be able to find your desired investment and place your first trade.